Crypto Investor, crypto market moves fast — and without a clear plan, you’re likely to make emotional, impulsive decisions that hurt your long-term gains.

A well-defined crypto investment strategy helps you reduce risks, stay focused, and capture real opportunities before the crowd.

In this guide, we break down the 7 key reasons why every crypto investor needs a strategy, no matter your level of experience.

Why a Crypto Investment Strategy is Essential

The cryptocurrency market is renowned for its volatility, rapid innovation, and complex technical landscape. Without a clear strategy, investors can find themselves adrift, making impulsive decisions that lead to significant losses or missed opportunities. Here are seven detailed reasons why every crypto investor needs a well-defined approach:

-

Mitigating Emotional Decision-Making: The crypto market’s dramatic price swings can trigger strong emotions like fear (FUD – Fear, Uncertainty, Doubt) when prices plummet and greed (FOMO – Fear Of Missing Out) when they surge. A clear strategy acts as a rational anchor, providing a framework for decision-making independent of emotional impulses. This means having predefined entry and exit points, risk tolerance levels, and a plan for market downturns, preventing panicked selling or reckless buying based on hype.

-

Defining Risk Tolerance and Managing Capital Effectively: Before investing, a strategy helps you honestly assess your risk tolerance. Are you comfortable with high-stakes investments, or do you prefer a more conservative approach? This assessment dictates the percentage of your portfolio allocated to crypto, the types of cryptocurrencies you invest in (e.g., established large-caps vs. speculative altcoins), and the size of individual positions. A clear strategy includes rules for capital allocation, stop-loss orders, and profit-taking, ensuring you don’t overexpose yourself and can weather market downturns without significant financial distress.

-

Setting Realistic Goals and Expectations: Without a strategy, investing in crypto can feel like gambling, driven by the hope of quick riches. A well-defined strategy forces you to set realistic, measurable, achievable, relevant, and time-bound (SMART) goals. Are you aiming for long-term wealth accumulation, short-term trading profits, or diversification? Setting these goals helps you choose appropriate investments, manage your expectations, and avoid disappointment when the market doesn’t perform as spectacularly as some sensational headlines suggest.

-

Navigating Market Volatility and Bear Markets: Crypto markets are cyclical, experiencing periods of boom and bust. A robust strategy prepares you for these cycles. It might include a dollar-cost averaging approach to accumulate assets during bear markets, or a plan to rebalance your portfolio when certain assets become overvalued. Having a strategy for bear markets is especially crucial, as it prevents panic selling at the bottom and allows you to potentially acquire assets at discounted prices.

-

Identifying and Capitalizing on Opportunities: A clear strategy isn’t just about risk management; it’s also about identifying and capitalizing on opportunities. This involves research into different crypto sectors (DeFi, NFTs, Layer 2s, gaming), understanding underlying technology, and recognizing emerging trends. A strategy might involve a systematic approach to researching new projects, evaluating their potential, and deciding when and how to invest, rather than blindly following social media hype.

-

Ensuring Portfolio Diversification and Rebalancing: “Don’t put all your eggs in one basket” is especially true in crypto. A clear strategy dictates how you diversify your portfolio across different cryptocurrencies, blockchain networks, and use cases. This reduces the impact of any single asset’s poor performance. Furthermore, a strategy should include a plan for rebalancing your portfolio periodically, adjusting your holdings to maintain your desired asset allocation as market conditions change.

-

Providing a Framework for Learning and Adaptation: The crypto space is constantly evolving with new technologies, regulations, and market dynamics. A clear strategy isn’t rigid; it’s a living document that can be adapted and refined over time. It provides a framework for continuous learning, allowing you to incorporate new knowledge and adapt your approach as the market matures. This iterative process of learning, strategizing, executing, and reviewing is essential for long-term success in such a dynamic environment.

In conclusion, while the allure of quick gains can be tempting in the crypto market, a disciplined and strategic approach is paramount for sustainable success. It transforms speculative guessing into informed investing, helping you navigate the complexities, manage risks, and ultimately work towards your financial objectives.

Deepening the Strategic Dive: Why a Clear Strategy is Non-Negotiable for Crypto Investors

Beyond the fundamental reasons already discussed, a well-crafted crypto investment strategy serves as a critical compass, guiding investors through the often-treacherous and exhilarating waters of the digital asset market. Let’s explore more layers of its importance:

Facilitating Effective Research and Due Diligence: A clear strategy dictates what kind of information is relevant to your investment decisions. If your strategy focuses on long-term fundamental value, you’ll prioritize researching a project’s whitepaper, team, technology, use cases, adoption rates, and tokenomics. If you’re a short-term trader, your strategy will lean towards technical analysis, chart patterns, trading volume, and market sentiment indicators. Without a strategy, research can become a chaotic rabbit hole, leading to information overload and analysis paralysis. A defined approach helps you filter out noise and focus on data that supports your specific investment thesis.

Enhancing Accountability and Performance Tracking: When you have a strategy, you have a benchmark against which to measure your performance. This isn’t just about tracking profit and loss; it’s about understanding why you made certain gains or suffered losses. A strategy allows you to review your decisions objectively. Did you stick to your entry and exit points? Did your risk management protocols work as intended? By systematically tracking your trades and evaluating them against your strategy, you can identify patterns, learn from mistakes, and refine your approach for future investments. This process of self-assessment is vital for continuous improvement.

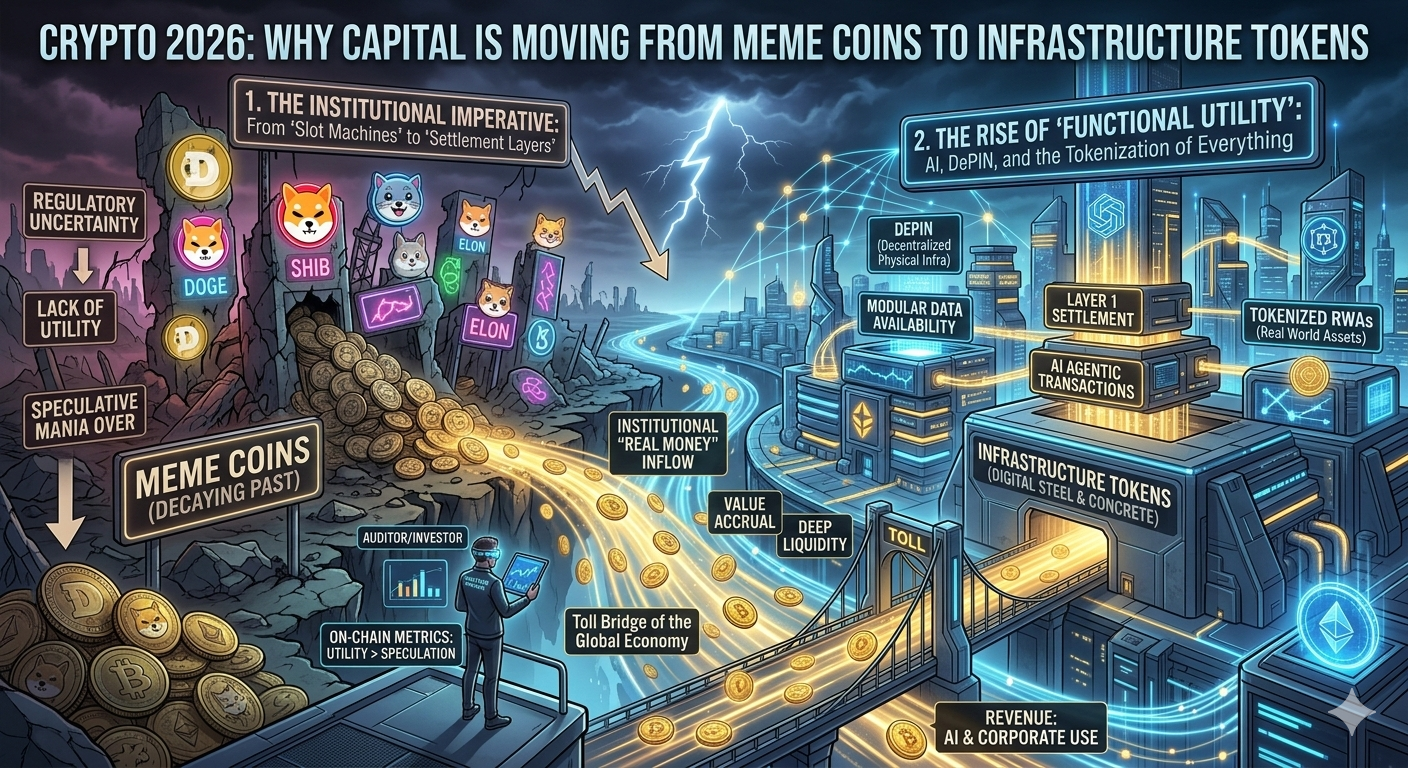

Adapting to Regulatory Changes and Emerging Narratives: The regulatory landscape for cryptocurrencies is still evolving globally, with new laws and guidelines emerging frequently. A clear strategy allows you to consider how these changes might impact your holdings. For instance, if your strategy favors decentralized projects, you might need to understand how potential DeFi regulations could affect them. Similarly, the crypto market is driven by narratives (e.g., “the year of AI tokens,” “the rise of RWA tokens”). A strategy helps you evaluate whether to engage with these narratives, how they fit into your overall goals, and when to potentially pivot, rather than being caught off guard by shifts in market sentiment.

Protecting Against Scams and Fraudulent Projects: The crypto space, unfortunately, is rife with scams, rug pulls, and fraudulent schemes. A well-defined strategy often includes a robust due diligence process that can act as a shield against these threats. For example, if your strategy emphasizes investing only in projects with publicly identifiable teams and a verifiable track record, you’re less likely to fall victim to anonymous pump-and-dump schemes. An awareness of common scam tactics, incorporated into your strategy, provides an additional layer of protection.

Optimizing for Tax Implications: While not the most exciting aspect, understanding the tax implications of your crypto investments is crucial. A clear strategy can help you plan for this. Are you holding for the long term to potentially qualify for lower capital gains tax rates? Are you frequently trading, which might subject you to higher income tax rates? Your strategy should ideally consider these factors, allowing you to make decisions that are not only financially sound from an investment perspective but also tax-efficient. Consulting with a tax professional who specializes in crypto is often a smart part of a comprehensive strategy.

Building Mental Resilience and Reducing Stress: The emotional rollercoaster of crypto investing can be incredibly stressful. Without a plan, every price fluctuation can feel like a personal attack or a missed opportunity. A strategy, however, instills a sense of control and purpose. When the market is crashing, you know why you’re holding, or when you might buy more. When it’s pumping, you know when to take profits. This reduces anxiety, allows for more peaceful sleep, and prevents burnout, which is surprisingly common among crypto investors who lack a clear direction.

In essence, a clear crypto investment strategy transforms a potentially chaotic and high-risk endeavor into a structured, manageable, and ultimately more rewarding journey. It empowers investors to be proactive rather than reactive, to learn and adapt, and to navigate the complexities of the digital asset world with greater confidence and a higher probability of achieving their financial aspirations.

Conclusion: The Indispensable Compass for Crypto Investing

In the dynamic and often tumultuous world of cryptocurrency, relying on luck, hype, or emotional whims is a surefire path to disappointment. As we’ve explored, a clear, well-defined strategy isn’t merely a suggestion for crypto investors; it’s an indispensable compass.

From mitigating emotional decisions and effectively managing risk to setting realistic goals and navigating market volatility, a strategic approach provides the bedrock for sound investment choices. It enables you to conduct more effective research, hold yourself accountable for your performance, and adapt to the ever-evolving regulatory landscape and emerging narratives. Furthermore, a robust strategy serves as a critical shield against scams and fraudulent projects, helps optimize for tax implications, and significantly contributes to building mental resilience amidst market swings.

Ultimately, a strategy transforms crypto investing from a gamble into a structured, informed pursuit. It empowers you to make proactive decisions, learn from every outcome, and steer your portfolio with greater confidence and purpose towards your financial aspirations. Without it, you’re simply adrift in a vast, unpredictable ocean.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.