Preserve your financial privacy while trading cryptocurrencies with our comprehensive guide to 14 top-tier no-KYC exchanges. Avoid the hassle of identity verification and maintain full control over your digital assets. We meticulously rank and review these platforms based on factors such as supported trading pairs, fee structure, withdrawal speed, and security measures. Discover which exchanges excel in providing a secure and anonymous trading experience.

Unmasking the Best No-KYC Crypto Exchanges

Let’s delve into the world of cryptocurrency trading without compromising your privacy. This section provides in-depth reviews of the top-rated exchanges that operate without requiring users to undergo Know Your Customer (KYC) verification. Discover the ideal platform to suit your trading needs.

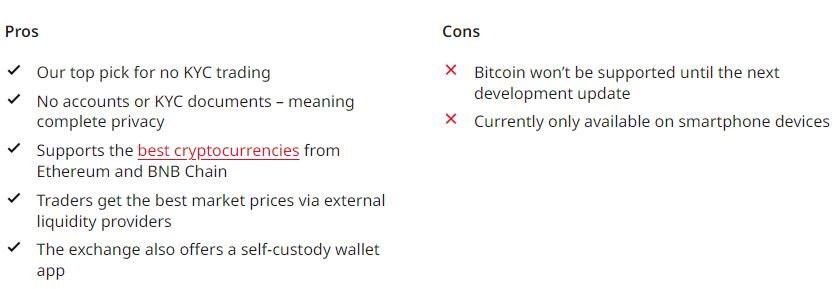

Best Wallet: Your All-in-One No-KYC Exchange

Best Wallet offers a seamless blend of security, anonymity, and trading convenience. As a self-custody wallet and integrated exchange, it empowers users to retain full control over their digital assets while enjoying frictionless trading. Best Wallet eliminates the need for account creation or KYC verification, ensuring complete privacy. With extensive support for Ethereum and BNB Chain tokens, including popular meme coins, users can effortlessly buy and sell at competitive rates.

Leveraging multiple liquidity providers, Best Wallet offers zero-fee trading, allowing users to pay only the minimal fees charged by liquidity providers. Purchased tokens are instantly credited to the user’s Best Wallet balance, enhancing trading efficiency.

Best Wallet offers unparalleled accessibility and security. Access your funds conveniently through the user-friendly Android or iOS app. A browser extension is in development for added flexibility and will be available in the near future. To expand its cryptocurrency offerings, Best Wallet is also integrating Bitcoin support. Prioritizing user security, the platform incorporates robust protection measures such as biometric authentication, two-factor verification, and a unique backup passphrase, making it the premier no-KYC crypto exchange for safeguarding your assets.

Furthermore, Best Wallet is considered the best peer-to-peer cryptocurrency exchange based on our evaluation.

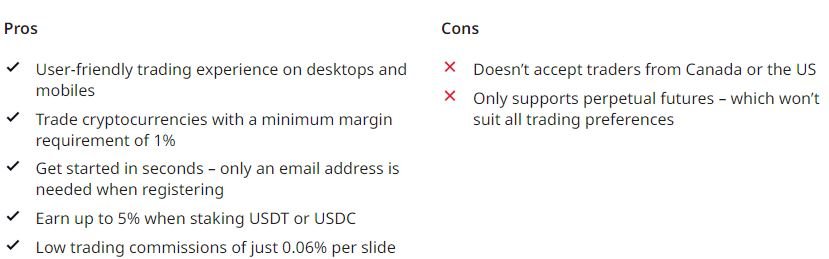

Margex: Low-Margin, No-KYC Crypto Derivatives Trading

Margex is a global trading platform that caters to traders seeking anonymity and leverage. With a simple email and password, users can create accounts and fund them anonymously with various cryptocurrencies like Bitcoin, Ethereum, and USDT. Specializing in perpetual futures, Margex stands out with its exceptionally low margin requirements.

For instance, traders can open BTC/USD positions with just a 1% margin, potentially amplifying returns by 100x. The platform also offers a robust suite of trading tools, including technical indicators and customizable charts. Accessible via both desktop and mobile apps (Android and iOS), Margex provides a versatile trading experience.

Margex provides a seamless trading environment complemented by competitive pricing. Traders benefit from low commissions of just 0.06% per slide. The platform also offers staking opportunities for USDT and USDC, allowing users to earn up to 5% on their holdings. It’s essential to note that Margex operates without significant regulatory oversight, which may limit investor protections.

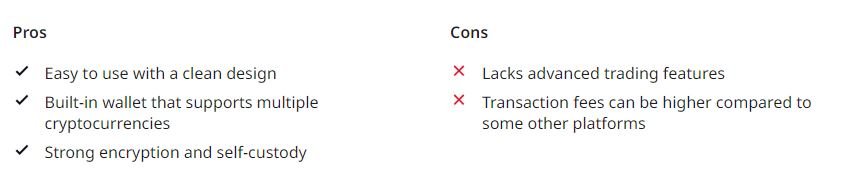

Exodus: Your All-in-One No-KYC Wallet and Trading Platform

Exodus offers a user-friendly platform that combines the functionalities of a cryptocurrency wallet and a trading exchange. With Exodus, you can effortlessly swap between thousands of digital assets, invest in staking, manage multiple portfolios, and explore the world of Web3. Access this comprehensive platform through desktop and mobile apps (iOS and Android) or the convenient Chrome browser extension.

Purchasing cryptocurrency with Exodus is a straightforward process. Simply download the app, extension, or open it in Chrome. Navigate to the Buy & Sell section, select your preferred payment method (debit card, bank account, credit card* – *availability may vary), enter the amount, and choose the desired cryptocurrency. Transaction speed depends on the chosen payment method and fiat provider, but you can generally expect quick delivery to your Exodus wallet.

Exodus offers a wide range of payment options: debit cards, bank accounts (availability may vary), credit cards* (limited availability*), popular e-wallets like PayPal, Apple Pay, and Google Pay, and fiat-to-crypto services through Blockchain.com Pay, MoonPay, PayPal, Ramp, Robinhood Connect, and Sardine.

While Exodus prioritizes user convenience and self-custody, it’s important to note that fees might be higher compared to centralized exchanges. Additionally, for larger purchases or frequent transactions, some basic identity verification might be required, with advanced verification necessary in specific cases.

BingX: Secure, No-KYC Platform for Spot and Derivatives Trading

BingX is a highly-regarded cryptocurrency exchange offering a diverse range of trading options, including spot trading and derivatives. Account creation is straightforward, requiring only an email address. Notably, users can withdraw up to $50,000 daily without undergoing KYC verification when dealing with cryptocurrencies.

Fiat transactions, however, necessitate KYC compliance. BingX prioritizes user security with robust measures such as two-factor authentication and AI-driven risk management. Furthermore, the exchange provides 100% proof of reserves, assuring users of the safety of their funds.

BingX provides a user-friendly platform for discovering cryptocurrencies to trade across various categories. Traders can explore tokens from specific ecosystems like Ethereum, Solana, or Toncoin, or delve into thematic markets such as meme, GameFi, and AI. BingX boasts highly competitive spot trading fees of just 0.1% per slide. For derivatives trading, perpetual and delivery futures attract fees of 0.05% and 0.045%, respectively.

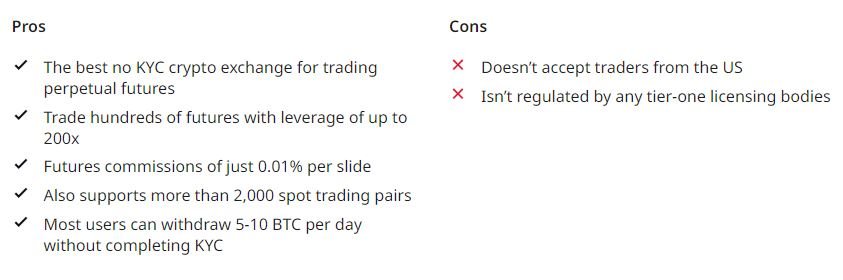

MEXC: High-Leverage Futures Trading with Low Fees

MEXC is a leading cryptocurrency exchange renowned for its deep liquidity, extensive market offerings, and competitive fees. The platform supports over 2,000 cryptocurrencies, including niche tokens, and charges a modest 0.1% fee for spot trading.

MEXC truly excels in derivatives trading, particularly perpetual futures. With hundreds of futures contracts available and a minimal margin requirement of just 0.5%, traders can leverage their positions up to 200x.

MEXC offers cost-effective perpetual futures trading with a competitive fee of just 0.01% per slide. The platform’s KYC requirements are minimal, requiring only an email or phone number and password to get started. While withdrawal limits without KYC verification can vary, most users can withdraw up to 5-10 Bitcoin per day.

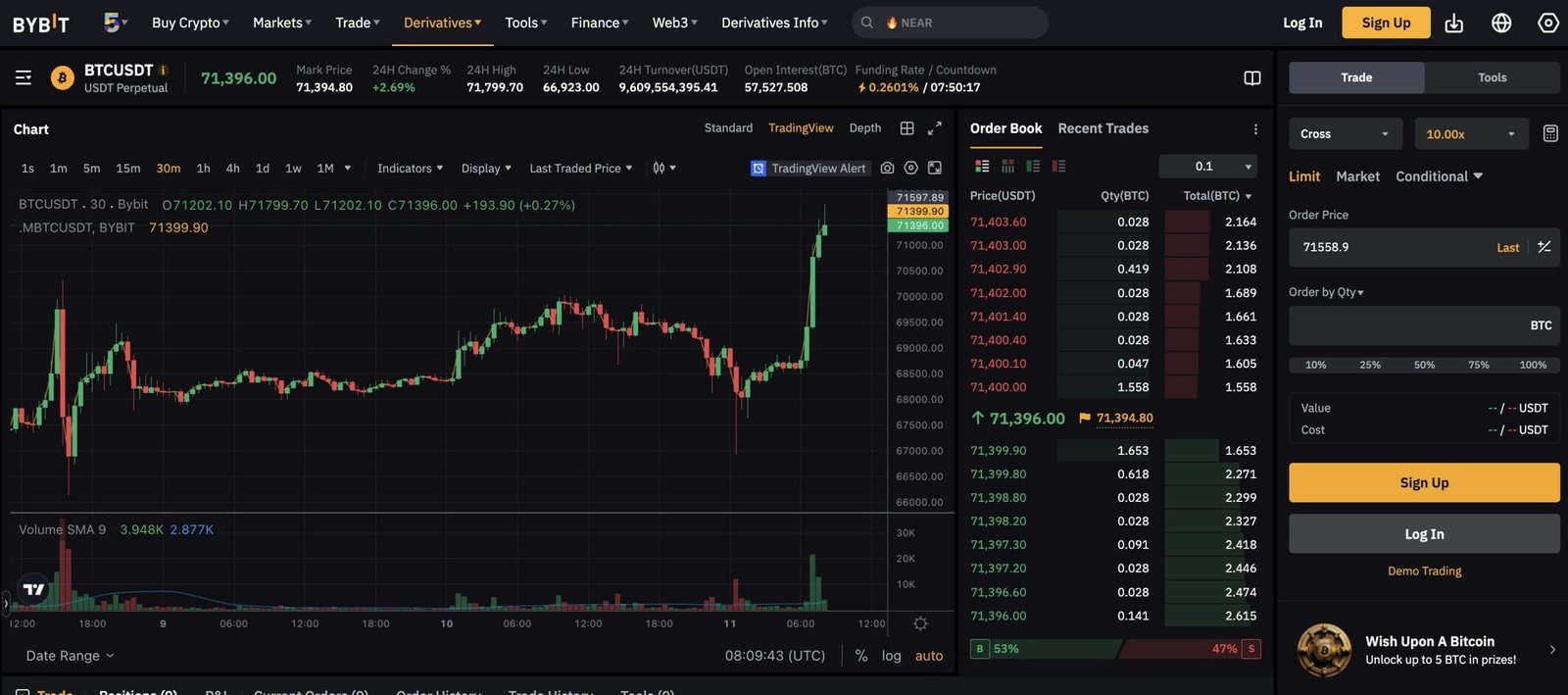

Bybit: High-Leverage Derivatives Trading with No KYC Restrictions

Bybit is a premier cryptocurrency exchange specializing in derivatives trading. The platform offers a wide range of futures contracts, including perpetual, inverse, and delivery futures, as well as options. Traders can leverage their positions up to 125x, significantly amplifying potential returns. To enhance flexibility, Bybit supports both USDT and USDC settled contracts.

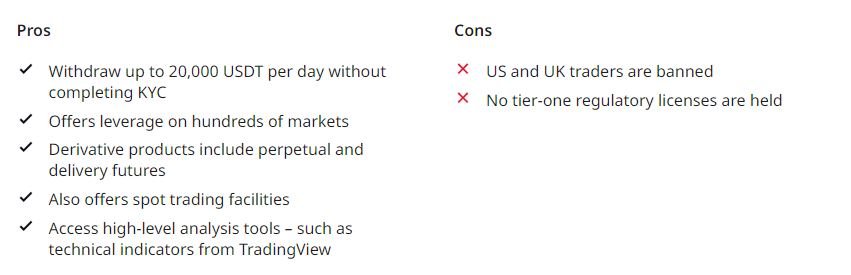

Account creation is swift and straightforward, requiring no personal information. Users can withdraw up to 20,000 USDT per day without completing KYC verification.

Bybit offers the convenience of withdrawing up to 20,000 USDT daily without requiring KYC, catering to a wider range of traders. However, it’s crucial to note that Bybit is an unregulated exchange, and users should exercise caution when holding substantial balances. Additionally, the platform is inaccessible to traders from the United States and the United Kingdom. Despite these limitations, Bybit remains a viable option for many international traders.

The Benefits of No-KYC Crypto Exchanges

One of the primary advantages of utilizing a no-KYC cryptocurrency exchange is the preservation of anonymity. Unlike traditional exchanges such as Coinbase, Kraken, and even Binance, which are subject to stringent KYC regulations, no-KYC platforms prioritize user privacy. These exchanges eliminate the need for users to disclose personal information and submit identification documents, such as passports or government-issued IDs.

Additionally, proof of address verification, commonly required by KYC procedures, is not necessary on no-KYC platforms. By simply providing an email address, users can begin their trading journey.

No-KYC exchanges foster greater inclusivity and expanded trading options. By eliminating the need for location verification, these platforms open doors to individuals worldwide, regardless of their geographic location. Furthermore, no-KYC exchanges often provide access to a broader range of trading instruments, including derivatives like perpetual futures and options, which may be restricted to professional traders on traditional exchanges.

It’s essential to note that while no-KYC platforms offer increased privacy and accessibility, they are not entirely immune to regulatory scrutiny. Exchanges retain the right to request KYC information under specific circumstances, particularly when suspicious activity is detected.

How to Buy Crypto Without KYC

It takes minutes to get started with a no KYC crypto exchange. Here’s a step-by-step walkthrough for beginners:

Step 1: Choose a No KYC Exchange

There are many no KYC exchanges to choose from – select the best one for your preferences. Consider factors like supported pairs and trading products, commissions, withdrawal limits, and security.

Scroll up for a recap on the 10 best no KYC crypto exchanges for 2024.

Step 2: Open an Anonymous Account

Visit your chosen exchange and open an account. This will only require an email address or a cell phone number, plus a password.

Step 3: Deposit Crypto

The next step is to deposit some crypto. The exchange will provide a unique deposit address. Open your wallet and transfer the respective crypto coins.

While most exchanges also accept fiat money, KYC requirements might be triggered. That said, some platforms allow small fiat deposits without ID verification.

Step 4: Start Trading

Once the account is funded, you can begin trading. Search for a crypto market – such as Bitcoin or Dogecoin. Set up an order by typing in the investment size.

Choose between a market or limit order, and don’t forget to deploy stop-losses and take-profits.

Step 5: Withdraw Funds

You can withdraw your account balance at any time. Just remember that most no KYC crypto exchanges have 24-hour limits. That said, this is often at least $10,000, which should suffice for most.

Conclusion

While many leading cryptocurrency exchanges have implemented stringent Know Your Customer (KYC) procedures, a range of no-KYC platforms remain viable options for traders. These exchanges often permit substantial withdrawal limits without requiring identity verification.

However, it’s crucial to exercise caution. Most no-KYC exchanges operate outside of established regulatory frameworks, potentially exposing users to increased risks. Thorough research and due diligence are essential before selecting a platform.

Prioritize platform security, reputation, and the specific features that align with your trading needs.