The world of cryptocurrency is often characterized by rapid innovation and fervent community excitement. However, while hype can certainly fuel initial interest, it’s rarely enough to sustain a crypto project in the long term. This is where tokenomics comes in, acting as the fundamental economic blueprint that dictates a token’s value, utility, and overall viability.

Tokenomics Explained: Why Hype Isn’t Enough in Crypto Projects

What is Tokenomics?

Tokenomics is a portmanteau of “token” and “economics.” It refers to the study and design of the economic aspects of a cryptocurrency or blockchain project, specifically focusing on its native digital tokens. It encompasses a comprehensive framework that includes:

- Token Supply: This includes the total maximum supply (if any), the circulating supply, and the mechanisms by which new tokens are created (minted) or removed (burned) from circulation.

- Token Distribution: How tokens are initially allocated among different stakeholders (e.g., development team, early investors, community, treasury, etc.) and the vesting schedules that dictate when these tokens become available.

- Token Utility: The practical use cases and functions of the token within its ecosystem. This is arguably the most crucial element, as it determines the token’s intrinsic value.

- Incentive Structures: Mechanisms designed to encourage desired behaviors from users, developers, and validators, such as staking rewards, yield farming, or play-to-earn models.

- Governance Models: How token holders can participate in the decision-making process of the project, often through voting on proposals.

- Monetary Policy: Rules governing the issuance, burning, and overall supply management of the token to control inflation or deflation.

Why Hype Isn’t Enough: The Importance of Solid Tokenomics

Hype can generate initial pumps and speculative trading, but without sound tokenomics, a project is built on a shaky foundation. Here’s why tokenomics is critical for a crypto project’s long-term success and sustainability:

-

Sustainable Value Creation:

- Supply and Demand: A well-designed tokenomics model balances supply and demand. Scarcity (like Bitcoin’s fixed supply) can drive value, while excessive or uncontrolled issuance can lead to inflation and devaluation.

- Real Utility: Tokens need a genuine purpose beyond speculation. If a token is integral to using a platform’s services (e.g., paying transaction fees, accessing features, staking for security), it creates consistent demand. Without utility, the token is simply an investment vehicle susceptible to rapid depreciation.

- Incentive Alignment: Tokenomics should align the interests of all participants – users, developers, and investors. Fair incentives encourage long-term commitment and participation, fostering a thriving ecosystem.

-

Long-Term Viability and Growth:

- Preventing Dilution: Clear vesting schedules and controlled issuance prevent early investors or team members from dumping large amounts of tokens on the market, which can crash the price and erode investor confidence.

- Community Engagement: Governance models empower token holders, giving them a voice in the project’s direction. This fosters a sense of ownership and encourages sustained engagement.

- Funding and Development: A robust tokenomics model attracts long-term investors and provides a sustainable funding mechanism for ongoing development, research, and marketing.

-

Market Stability and Trust:

- Reduced Volatility: Thoughtful tokenomics can help mitigate extreme price swings by controlling supply and creating consistent demand.

- Transparency and Fairness: Clearly defined tokenomics in a whitepaper or public documentation builds trust. Investors can assess the project’s economic health and understand how their investment might perform.

- Mitigating Risks: Mechanisms like token burning can introduce deflationary pressure, counteracting inflation and potentially increasing the value of remaining tokens.

Common Pitfalls in Crypto Tokenomics:

Many projects fail due to poorly designed tokenomics, even if they have a promising idea. Some common mistakes include:

- Unlimited or Excessive Supply: Without proper burning mechanisms or demand, an uncapped supply can lead to rampant inflation and devalue the token.

- Lack of Utility: If the token doesn’t have a clear and compelling use case within its ecosystem, it becomes purely speculative and highly vulnerable to market fluctuations.

- Poor Vesting Schedules: Releasing too many tokens too quickly to early investors or the team can lead to massive sell-offs, causing price crashes.

- Unfair Distribution: If a large portion of tokens is concentrated in the hands of a few early investors or the project team, it raises concerns about centralization and potential manipulation.

- Over-reliance on Speculation: Projects that prioritize short-term price pumps over building real utility and a sustainable ecosystem often fizzle out.

- Complex or Opaque Models: Tokenomics that are overly complicated or not clearly explained can deter potential users and investors.

Examples of Successful Tokenomics:

- Bitcoin (BTC): Its fixed supply of 21 million BTC, coupled with a predictable halving schedule, creates inherent scarcity and deflationary pressure, making it a strong store of value.

- Ethereum (ETH): While it doesn’t have a hard cap, its use as “gas” for transactions and DApp interactions, along with deflationary mechanisms introduced by EIP-1559 (burning a portion of transaction fees), drives significant demand. Its transition to Proof-of-Stake (staking ETH to secure the network) further aligns incentives.

- PancakeSwap (CAKE): As a leading DeFi DEX, CAKE’s value is driven by real platform usage (trading fees), consistent token burns, and high community engagement through yield farming, staking, and governance.

While initial hype can generate excitement, sustainable success in the crypto space hinges on meticulously designed and transparent tokenomics. A robust economic model that emphasizes utility, fair distribution, aligned incentives, and responsible supply management is the true foundation for a project to thrive beyond the initial buzz and build a lasting impact. Investors and users should look beyond the marketing and delve deep into a project’s tokenomics to assess its genuine potential for long-term growth.

The Interconnectedness of Tokenomics Components

It’s crucial to understand that the different components of tokenomics don’t operate in isolation. They form a complex, interconnected system where changes in one area can significantly impact others.

- Supply and Scarcity: While a fixed, limited supply (like Bitcoin’s 21 million BTC) inherently creates scarcity and can drive value over time, it’s not a universal solution. An uncapped supply can work if there are strong burning mechanisms (permanently removing tokens from circulation) or ever-increasing demand for the token’s utility. Without these countermeasures, an inflationary supply will inevitably dilute value.

- Utility and Demand: The core purpose of a token is its utility. If a token is simply a speculative asset with no real-world use case within its ecosystem, its demand will be purely speculative, leading to high volatility and eventual decline.

- Medium of Exchange: Tokens used to pay for services or products within an ecosystem (e.g., transaction fees, platform subscriptions) create continuous transactional demand.

- Governance: Tokens that grant voting rights in a Decentralized Autonomous Organization (DAO) incentivize holding to influence the project’s direction, fostering community engagement.

- Staking/Yield Farming: Locking up tokens to secure the network or provide liquidity (staking, yield farming) reduces circulating supply and rewards holders, creating an incentive to hold and participate.

- Access/Exclusive Features: Tokens that unlock premium features, exclusive content, or early access to a project’s offerings create a tangible benefit for holding.

- Distribution and Fairness: The initial distribution of tokens is critical.

- Initial Coin Offerings (ICOs)/Initial Exchange Offerings (IEOs): While fundraising methods, they need to be designed to ensure fair access and prevent concentration in a few hands.

- Airdrops: Distributing tokens for free to early users or community members can bootstrap a network and foster decentralization.

- Mining/Staking Rewards: These mechanisms distribute newly minted tokens to those who secure the network, aligning incentives for honest participation.

- Vesting Schedules: Especially for team members, early investors, and advisors, robust vesting schedules (releasing tokens gradually over time) are essential to prevent large-scale dumping that can crash the price. A lack of proper vesting is a major red flag.

The Role of Game Theory and Behavioral Economics

Tokenomics draws heavily from economic theories, particularly game theory and behavioral economics.

- Game Theory: This helps design incentive structures that encourage desired behaviors from participants. For example, staking rewards in Proof-of-Stake systems are designed so that acting honestly (validating transactions correctly) yields more rewards than attempting to cheat. This “game” incentivizes network security.

- Behavioral Economics: This field helps understand how human psychology influences economic decisions. For instance, the perception of scarcity can drive irrational buying behavior, and well-communicated roadmaps can foster long-term holding by appealing to future potential. Understanding these psychological drivers helps design more effective tokenomics.

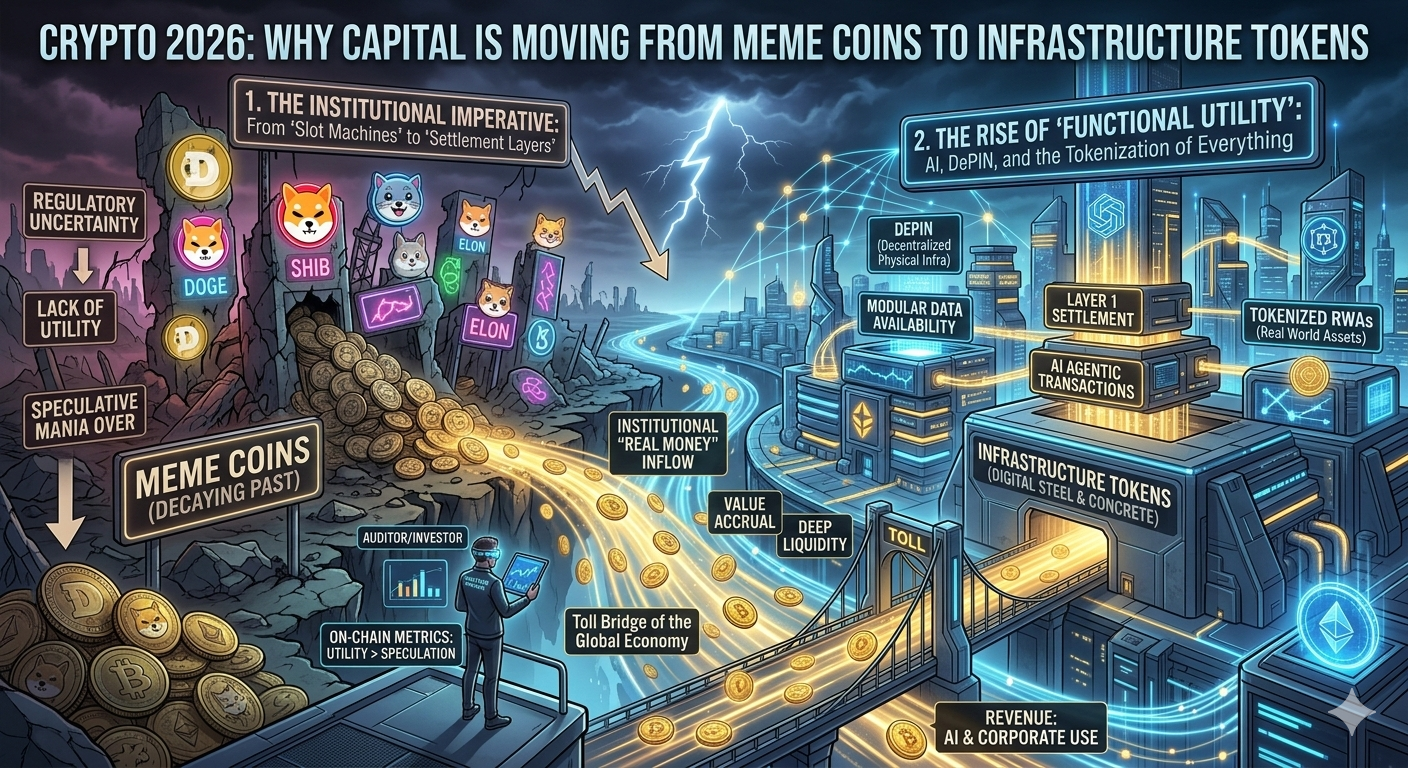

Auditing Tokenomics: A Growing Necessity

As the crypto space matures, the importance of independent tokenomics audits is gaining traction. Just as smart contracts are audited for security vulnerabilities, a comprehensive tokenomics audit evaluates:

- Economic Soundness: Are the supply, demand, and incentive mechanisms balanced? Is there a risk of hyperinflation or death spirals?

- Fairness and Transparency: Is the distribution fair? Are vesting schedules clearly defined and reasonable?

- Sustainability: Can the project sustain its development and operations with its tokenomics model in the long run?

- Potential Risks: Identification of potential vulnerabilities like concentration of power, manipulative practices, or economic exploits.

Beyond the Numbers: Community and Vision

While tokenomics provides the economic framework, it’s also deeply intertwined with a project’s community and overarching vision.

- Community: An engaged, passionate community can offset some minor tokenomics imperfections, as collective belief and participation can drive demand. However, a strong community can’t save a fundamentally flawed economic model.

- Vision and Roadmap: A clear, ambitious, and achievable roadmap gives utility to the token over time. If a project constantly delivers on its promises and expands its ecosystem, the utility of its token naturally grows, reinforcing its value. Without a compelling vision, even perfect tokenomics might struggle to attract sustained interest.

Tokenomics is the true backbone of any successful crypto project. Hype might get a project off the ground, but only meticulously crafted and transparent tokenomics can ensure its long-term viability, foster genuine value creation, and build enduring trust within the decentralized landscape. For anyone looking to invest in or build within the crypto space, a deep understanding and critical evaluation of a project’s tokenomics are paramount. It’s the difference between a fleeting trend and a foundational innovation.

Conclusion

In the dynamic and often speculative world of cryptocurrency, the allure of quick gains fueled by marketing hype can be powerful. However, as this exploration has detailed, hype is a fleeting spark; tokenomics is the enduring flame.

Tokenomics represents the intricate economic architecture of a blockchain project, defining everything from a token’s supply and distribution to its utility, incentive structures, and governance. It’s the blueprint that determines whether a crypto asset can transcend mere speculation and cultivate sustainable, intrinsic value.

A well-designed tokenomics model ensures:

- Sustainable Value Creation: By balancing supply and demand through mechanisms like controlled issuance, real utility, and effective burning strategies.

- Long-Term Viability: Through fair distribution, robust vesting schedules that prevent market dumps, and incentive alignment that encourages consistent participation and development.

- Market Stability and Trust: By providing transparency, predictability, and mechanisms to mitigate volatility, fostering confidence among users and investors.

Conversely, projects built solely on hype, lacking a sound economic foundation, are destined for instability and eventual decline. Common pitfalls such as unlimited supply, absence of genuine utility, unfair distribution, and over-reliance on speculative trading invariably lead to diluted value and eroded trust.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.