The Future of Crypto: Understanding an Evolving Ecosystem” encapsulates the dynamic and forward-looking nature of the cryptocurrency space. To delve deeper into this, we need to explore the key aspects of this evolution, including technological advancements, regulatory landscapes, adoption trends, and the challenges and opportunities that lie ahead.

The Future of Crypto: Understanding an Evolving Ecosystem

Technological Advancements Driving Evolution

The cryptocurrency ecosystem is in constant flux, driven by relentless technological innovation. Some key advancements shaping its future include:

- Layer-2 Scaling Solutions: Addressing the scalability limitations of first-generation blockchains like Bitcoin and Ethereum is crucial for mainstream adoption. Layer-2 solutions such as rollups (Optimism, Arbitrum), sidechains, and state channels are enhancing transaction throughput and reducing fees, making crypto more practical for everyday use. For example, transaction speeds on Ethereum have significantly improved with the increasing adoption of Optimism and Arbitrum.

- Interoperability: The ability for different blockchains to communicate and exchange value seamlessly is becoming increasingly important. Projects like Polkadot and Cosmos are focused on building “internet of blockchains,” enabling cross-chain asset transfers and data sharing. This interoperability could unlock new use cases and liquidity across different crypto networks.

- Decentralized Finance (DeFi) Innovations: DeFi continues to evolve beyond basic lending and borrowing. We are seeing advancements in decentralized exchanges (DEXs) with improved user experience and lower fees, novel yield-generating strategies, and the integration of real-world assets (RWAs) into DeFi protocols through tokenization. For instance, platforms are emerging that allow users to earn yield on tokenized real estate or commodities.

- Non-Fungible Tokens (NFTs) and Web3 Integration: NFTs have moved beyond digital art and collectibles, finding applications in areas like ticketing, loyalty programs, and digital identity. Their integration with the broader Web3 ecosystem, including metaverse platforms and decentralized social networks, is creating new forms of digital ownership and interaction.

- Artificial Intelligence (AI) and Machine Learning (ML): The intersection of AI/ML and crypto is opening up possibilities for enhanced security through anomaly detection, improved trading strategies via predictive analytics, and more efficient smart contract auditing. AI could also play a role in personalized user experiences within DeFi and NFT platforms.

- Sustainability and Green Initiatives: Concerns about the environmental impact of some cryptocurrencies, particularly those using Proof-of-Work consensus mechanisms, are driving a shift towards more sustainable alternatives. This includes the rise of Proof-of-Stake blockchains and various green crypto initiatives focused on carbon offsetting and energy efficiency. Ethereum’s transition to Proof-of-Stake is a prime example of this trend.

The Evolving Regulatory Landscape

Regulation is a critical factor shaping the future of crypto. Governments and regulatory bodies worldwide are grappling with how to address the unique challenges and opportunities presented by digital assets. Key trends in regulation include:

- Increased Focus on Consumer Protection and AML/KYC: Regulators are increasingly prioritizing the protection of investors from fraud and scams, as well as implementing stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements for crypto exchanges and service providers.

- Stablecoin Regulation: The rapid growth of stablecoins has led to increased scrutiny regarding their reserves and transparency. Regulations are being developed to ensure the stability and reliability of these digital assets.

- Integration of DeFi into Regulatory Frameworks: As the DeFi sector expands, regulators are beginning to explore how existing financial regulations might apply or need to be adapted to decentralized protocols. This is a complex area with ongoing discussions and pilot programs.

- Global Harmonization Efforts: There is a growing recognition of the need for more harmonized global standards for cryptocurrency regulation to avoid fragmentation and ensure consistent oversight. International organizations may play a larger role in establishing best practices.

- Development of Regulatory Sandboxes: Some jurisdictions are creating regulatory sandboxes to allow for experimentation with new crypto technologies in a controlled environment, fostering innovation while managing risks.

- Taxation Policies: Clearer tax guidelines for digital assets are being developed and implemented in various countries, impacting how individuals and businesses interact with cryptocurrencies.

The regulatory landscape in 2025 is dynamic, with different jurisdictions taking varying approaches. The interplay between innovation and regulation will be crucial in determining the future trajectory of the crypto ecosystem.

Adoption Trends and Institutional Interest

The adoption of cryptocurrencies is expanding beyond retail investors to include institutional players and mainstream businesses:

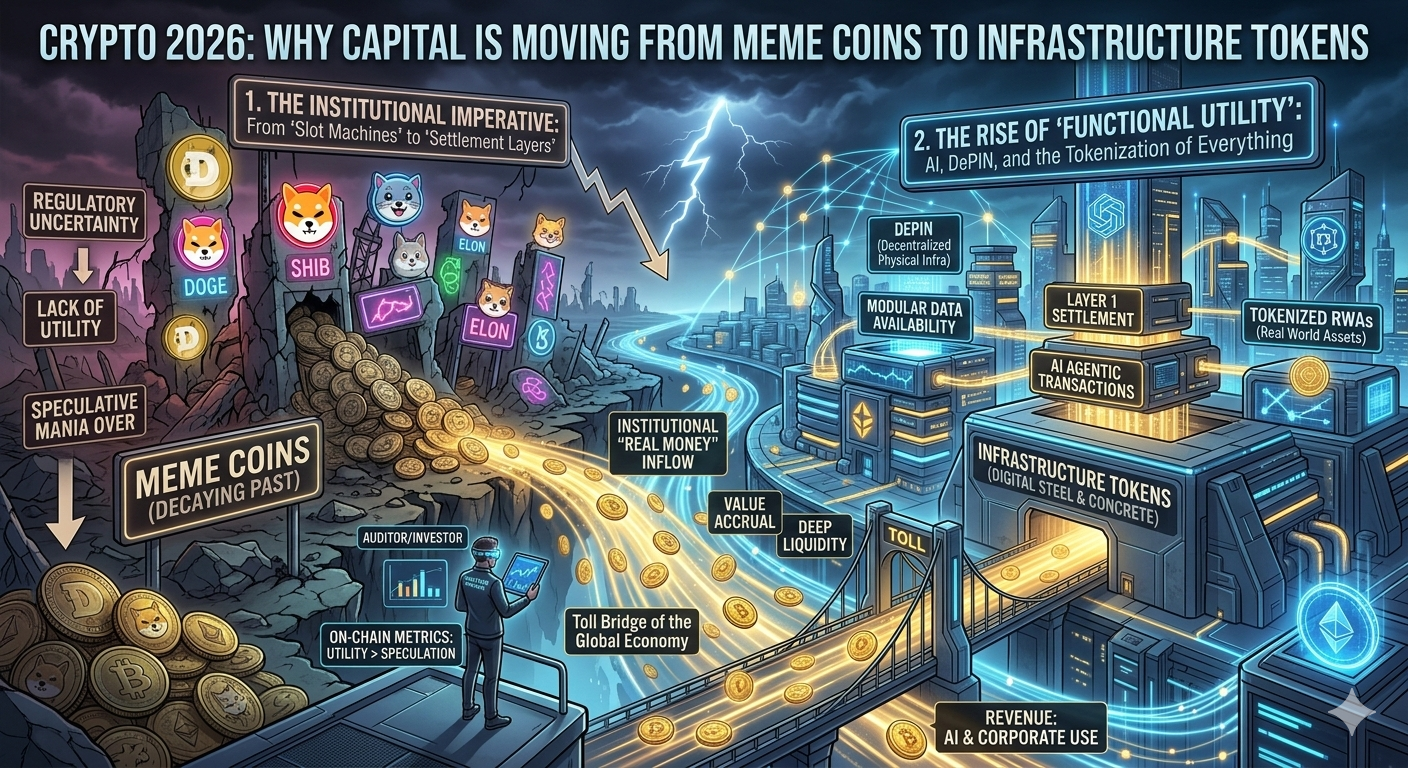

- Institutional Adoption: Traditional financial institutions, including banks, asset managers, and even pension funds, are increasingly exploring and integrating digital assets into their portfolios. The introduction of Bitcoin and Ethereum spot ETFs in some regions has provided a bridge between traditional finance and crypto.

- Corporate Adoption: More and more companies are holding cryptocurrencies on their balance sheets, using them for payments, or exploring blockchain-based solutions for various business processes.

- Tokenization of Real-World Assets: The trend of converting real estate, stocks, commodities, and other assets into digital tokens on blockchains is gaining traction. This can enhance liquidity, provide fractional ownership opportunities, and make traditionally illiquid assets more accessible to a wider range of investors.

- Integration with Traditional Payment Systems: Efforts are underway to integrate cryptocurrencies with existing payment infrastructure, making it easier for consumers to use digital assets for everyday transactions. Stablecoins play a significant role in this aspect.

- Growth in Emerging Markets: Cryptocurrency adoption is particularly strong in some emerging markets, where it can offer solutions for financial inclusion, remittances, and protection against currency devaluation.

These adoption trends signal a maturing ecosystem with broader applications and greater credibility.

Challenges and Opportunities

The evolving crypto ecosystem presents both significant challenges and exciting opportunities:

Challenges:

- Volatility: The price volatility of many cryptocurrencies remains a concern for mainstream adoption and can deter risk-averse investors.

- Security Risks: Despite technological advancements, the crypto space is still susceptible to hacks, scams, and fraud, requiring robust security measures and user education.

- Scalability and Network Congestion: While Layer-2 solutions are helping, achieving truly scalable and efficient blockchain networks remains a challenge for some platforms.

- Regulatory Uncertainty and Fragmentation: The lack of consistent and clear regulations across different jurisdictions can create uncertainty and hinder innovation.

- User Experience (UX): The complexity of using crypto wallets, exchanges, and decentralized applications can be a barrier to entry for new users.

- Environmental Concerns: The energy consumption of some blockchain technologies continues to be a point of contention.

- Centralization Risks: Concerns exist about potential centralization within certain DeFi protocols or the influence of large players in the crypto space.

Opportunities:

- Financial Inclusion: Cryptocurrencies and blockchain technology have the potential to provide financial services to the unbanked and underbanked populations globally.

- Innovation in Financial Services: DeFi is driving innovation in lending, borrowing, trading, and other financial activities, potentially leading to more efficient and transparent systems.

- New Forms of Digital Ownership: NFTs and blockchain technology are enabling new models of digital ownership and value creation for artists, creators, and consumers.

- Enhanced Efficiency and Transparency: Blockchain can improve efficiency and transparency in various industries, including supply chain management, voting, and identity verification.

- Decentralization and Censorship Resistance: Cryptocurrencies offer a decentralized alternative to traditional financial systems, providing greater control and censorship resistance to users.

- Cross-Border Payments: Cryptocurrencies can facilitate faster and cheaper cross-border payments compared to traditional methods.

- New Investment Opportunities: The crypto market offers diverse investment opportunities, although with varying levels of risk.

In conclusion, “The Future of Crypto: Understanding an Evolving Ecosystem” implies a journey of continuous transformation driven by technological innovation, evolving regulations, increasing adoption, and a complex interplay of challenges and opportunities. Understanding these dynamics is crucial for anyone involved in or observing this rapidly developing space. The crypto ecosystem of the future is likely to be more scalable, interoperable, regulated, and integrated into the broader financial and technological landscape.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.

One thought on “The Future of Crypto: Understanding an Evolving Ecosystem”