The crypto market is no longer just about price cycles and volatile swings. As we approach 2026, a new era is dawning, driven by powerful macroeconomic shifts, technological innovation, and a growing embrace from traditional finance. Here are the key macro trends that will define the crypto landscape in the coming year.

Macro Trends Shaping the Crypto Market: A 2026 Forecast

1. Global Monetary Policy and Economic Sentiment

The crypto market has always been sensitive to the actions of central banks. In 2026, expect these trends to have a significant impact:

- Easing Interest Rates: As major central banks like the U.S. Federal Reserve continue their trend of lowering interest rates, traditional safe-haven assets like bonds will offer lower returns. This will likely push institutional and retail investors to seek higher yields in riskier assets, with crypto being a primary destination for this capital.

- Increased Global Liquidity: The injection of liquidity into the global financial system by central banks can act as a powerful catalyst for risk assets. Historical data suggests that periods of expanding liquidity often align with major crypto bull runs, and 2026 is poised to see a continuation of this trend.

2. The Next Wave of Institutional Adoption

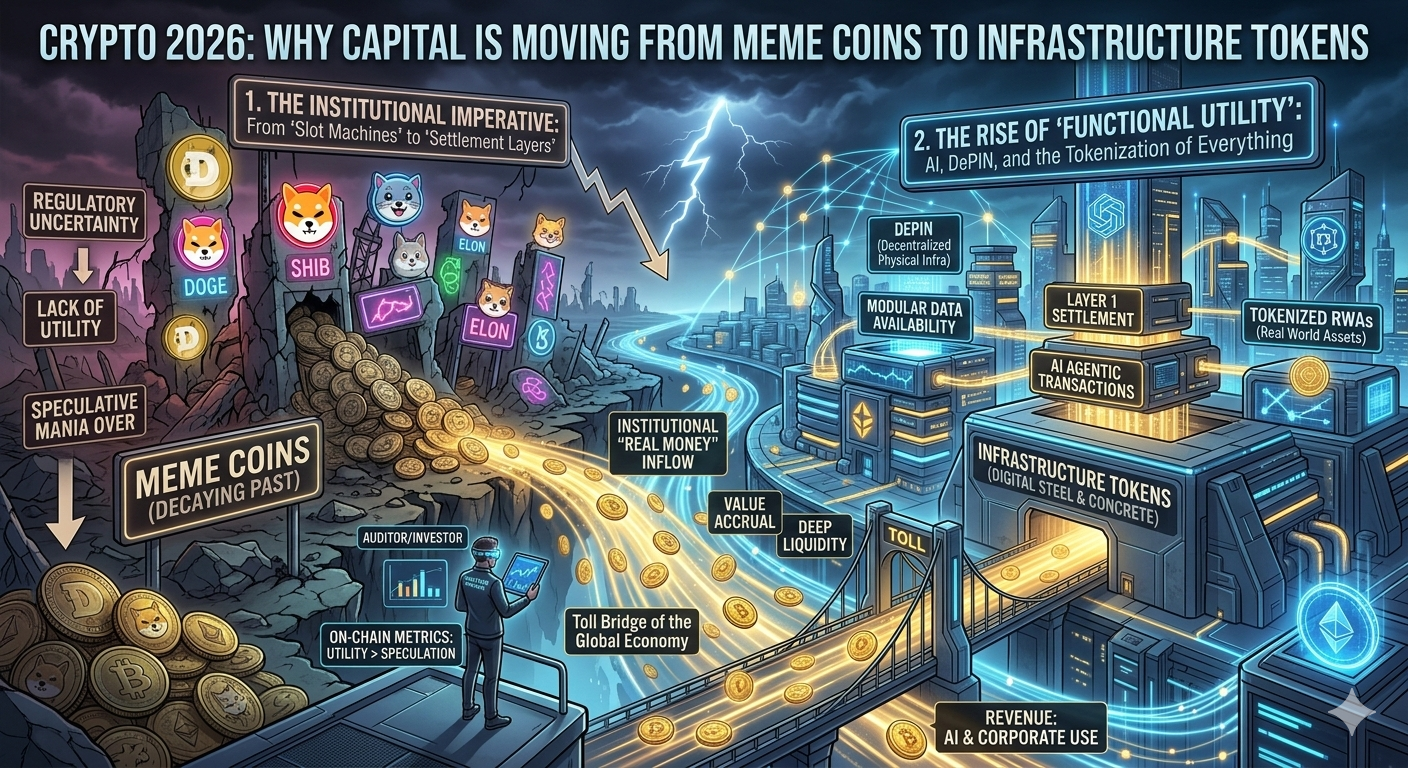

Institutional involvement is no longer a fringe phenomenon; it’s a core driver of the market. In 2026, this trend will accelerate in new ways:

- Spot ETF Diversification: Following the success of Bitcoin and Ethereum ETFs, the market will likely see the launch of spot ETFs for other major altcoins. This will open the floodgates for a new wave of capital from traditional investors who previously lacked a simple, regulated entry point.

- Corporate Treasury Adoption: More public and private companies are beginning to view Bitcoin as a strategic reserve asset. This trend is expected to grow, with more corporations adding crypto to their balance sheets as a hedge against inflation and a long-term investment.

- Mainstream Financial Integration: We’ll see traditional financial giants like the NYSE and Nasdaq further integrate spot crypto trading platforms, bridging the gap between legacy finance and the crypto market. This builds trust and provides the necessary infrastructure for institutional players to participate with confidence.

3. Technological and Ecosystem Evolution

Beyond market dynamics, the underlying technology continues to mature, creating new opportunities.

- Layer-2 Scalability: Layer-2 solutions, particularly on Ethereum, are moving from a niche topic to a mainstream necessity. By making transactions faster and cheaper, these technologies will drive mass adoption of decentralized finance (DeFi) and Web3 applications.

- Real-World Asset (RWA) Tokenization: The tokenization of traditional assets like real estate, bonds, and fine art is poised for massive growth. This trend not only brings a new wave of stability and value to the DeFi space but also connects the crypto world directly to the global economy.

- AI and Web3 Integration: The integration of AI into DeFi protocols is a key trend to watch in 2026. AI is expected to be used to automate risk management, optimize capital efficiency, and create smarter, more autonomous financial services.

4. A Maturing Regulatory Landscape

Clarity is a powerful catalyst. In 2026, the regulatory environment is set to become more defined, encouraging broader participation.

- U.S. Regulatory Frameworks: The U.S. is expected to move forward with clearer crypto regulations, creating a more predictable and secure environment for both businesses and investors. This clarity could set a global precedent, with other major economies following suit.

- Global Policy Alignment: More countries, including emerging markets, are developing specific legal frameworks for digital assets. This global shift towards regulatory recognition will create a safer environment for domestic and international investment.

2026 won’t just be about price predictions; it will be a year of fundamental transformation. The convergence of favorable macroeconomics, increased institutional adoption, and groundbreaking technological advances will likely propel the crypto market from its nascent stage into a period of more mature and sustainable growth.

Deeper Dive into Macroeconomic Factors

In 2026, the decisions of central banks and the state of the global economy will be the most significant factors influencing the crypto market.

- Loosening Monetary Policy: When central banks begin their rate-cutting cycles, it not only reduces the returns on traditional assets but also encourages borrowing. This can lead to a “great rotation” out of money market funds and into riskier assets. For crypto, this means Bitcoin and Ethereum become more attractive, viewed as a relative safe haven against inflation and a compelling growth asset.

- Exchange Rates and Geopolitical Instability: A weakening U.S. dollar incentivizes global investors to seek alternative assets, including cryptocurrencies. Furthermore, geopolitical tensions can fuel the demand for Bitcoin as a decentralized store of value, independent of traditional political and financial systems.

The Next Wave of Institutional Adoption: Deeper and Wider

Institutional adoption is no longer just about buying Bitcoin. In 2026, it will transition into a phase of systemic integration and portfolio diversification.

- Major Fund Participation: Beyond ETFs, 2026 could see pension funds and sovereign wealth funds begin allocating a small percentage of their portfolios to crypto. This would create a steady, enormous flow of capital, bringing long-term legitimacy and stability to the market.

- Infrastructure and Products: Major investment banks are building “prime brokerage” services for digital assets, allowing institutions to safely borrow against and trade crypto with leverage. This development will make complex trading strategies more viable and secure for institutional players.

Groundbreaking Technological Advancements

Technological trends are no longer just buzzwords. They are creating real-world applications that will redefine the market.

- AI Integrated with Web3: AI is revolutionizing Web3. On-chain AI models are being used to analyze data, automate DeFi trading strategies, and even govern decentralized protocols. This integration promises to make the decentralized ecosystem smarter and more efficient.

- DePIN (Decentralized Physical Infrastructure Networks): This is an emerging trend where blockchain is used to incentivize individuals to build and manage real-world infrastructure, such as wireless networks or energy grids. DePINs will create a new class of on-chain assets with real-world utility and sustainable revenue streams.

- Real-World Asset (RWA) Tokenization: The RWA boom will not be limited to real estate and bonds. In 2026, we could see the tokenization of loans, commercial accounts receivable, and even intellectual property rights, creating an entirely new financial market.

A Maturing Global Regulatory Environment

- International Cooperation: Countries will no longer develop regulations in isolation. We will see greater international cooperation on anti-money laundering (AML) standards and investor protection, creating a more level playing field and reducing regulatory risk for companies and projects.

- Asset Classification: A clearer classification of what constitutes a cryptocurrency versus a security will help developers and startups innovate with greater confidence, reducing the fear of litigation and encouraging new projects to emerge.

Conclusion

2026 will not just be a year of change but a year of convergence. When favorable macroeconomic factors meet groundbreaking technological advancements and the growing adoption by major institutions, the crypto market will enter a more mature and sustainable phase. For investors, this means the market will be less dependent on hype and more on real-world value, robust infrastructure, and stability.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.