Building a balanced crypto portfolio in 2025 is crucial for navigating the volatile market and maximizing long-term growth while managing risk. Here’s a detailed guide:

1. Define Your Investment Goals and Risk Tolerance

Before investing, clearly define:

- Investment Goal: Are you looking for long-term growth, passive income (through staking/yield farming), or short-term gains (trading)?

- Time Horizon: How long do you plan to hold your investments?

- Risk Tolerance: How much are you willing to lose? Crypto is inherently risky, and prices can fluctuate wildly. Only invest what you can afford to lose. This will dictate your asset allocation.

2. Diversify Your Portfolio Wisely

Diversification is the cornerstone of a balanced crypto portfolio. It’s not just about owning multiple cryptocurrencies, but spreading your investments across different categories and use cases to reduce risk and capture various growth opportunities.

A typical allocation might look like this, but should be adjusted based on your risk tolerance:

- Large-Cap Cryptocurrencies (50-60%): These are the “blue chips” of crypto, offering relative stability and a strong market presence.

- Bitcoin (BTC): Often considered “digital gold,” Bitcoin is the largest and most established cryptocurrency, acting as a store of value.

- Ethereum (ETH): The backbone of many decentralized applications (dApps), DeFi, and NFTs. Its continued development (e.g., Ethereum 2.0 upgrades) makes it a strong long-term hold.

- Mid-Cap Cryptocurrencies (20-30%): These projects have significant growth potential but come with higher risk than large-caps. Look for projects with solid fundamentals, strong development teams, and clear use cases.

- Layer-1 Blockchains (e.g., Solana, Avalanche, Polkadot): These aim to compete with or enhance Ethereum’s scalability and functionality.

- DeFi Tokens (e.g., Uniswap, Aave, Chainlink): Protocols powering decentralized finance, offering lending, borrowing, and trading services.

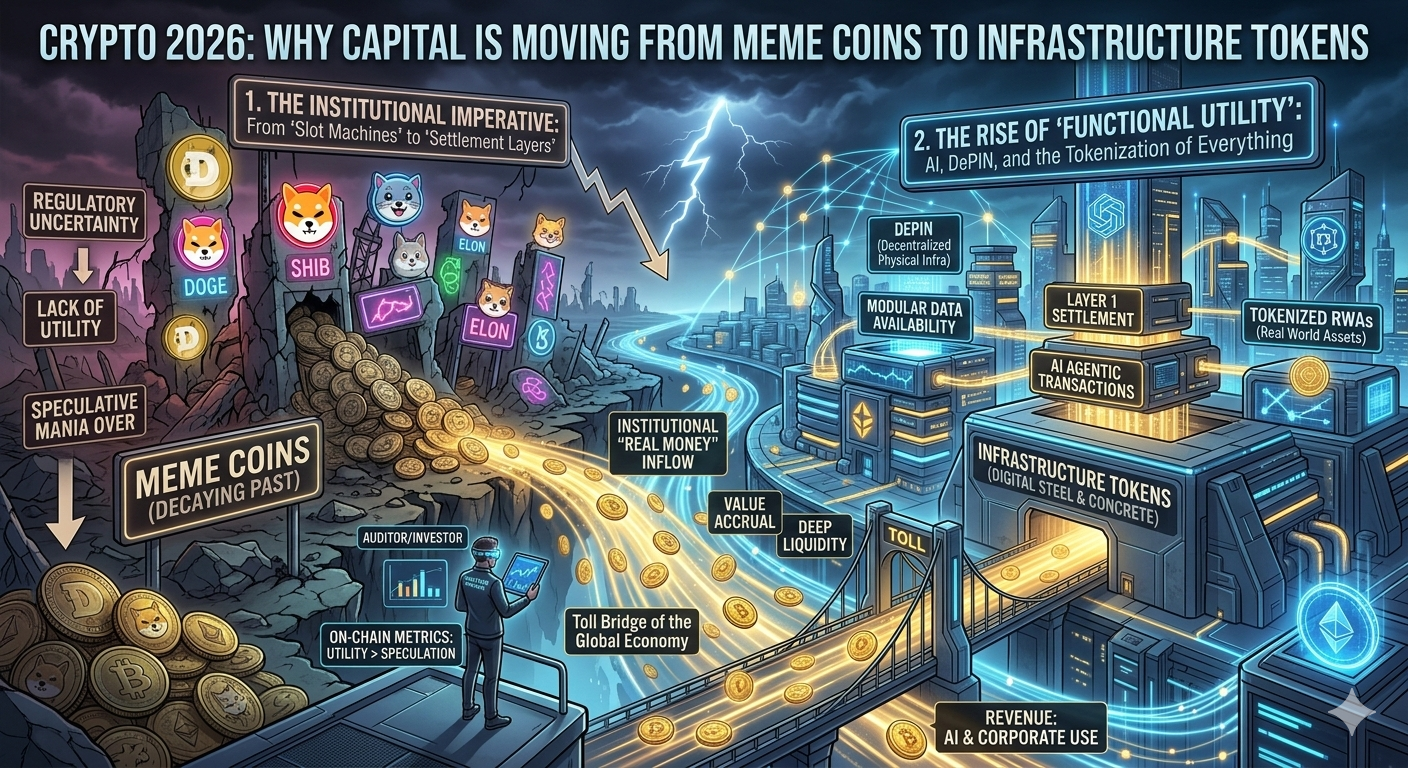

- Infrastructure Tokens: Projects that provide essential services for the crypto ecosystem (e.g., data storage, oracles).

- Small-Cap Cryptocurrencies / Emerging Projects (5-10%): These are higher-risk, higher-reward investments. They can offer explosive growth but also significant losses. Thorough research is critical here.

- New Narratives: Explore emerging trends like AI integration, DePIN (Decentralized Physical Infrastructure Networks), and Real-World Assets (RWAs) tokenization.

- Utility Tokens: Tokens serving specific functions within a blockchain ecosystem.

- Gaming Tokens: Exposure to the growing blockchain gaming sector.

- Note: Avoid “meme coins” unless you fully understand the extreme speculative nature and are willing to lose the entire investment.

- Stablecoins (5-10%): Pegged to fiat currencies (like USDT, USDC, BUSD), stablecoins provide liquidity and act as a hedge against market volatility. They are useful for:

- Capital Preservation: Protecting profits during market downturns.

- Liquidity: Being ready to “buy the dip” when opportunities arise.

- Yield Generation: Many platforms offer staking or lending opportunities for stablecoins, generating passive income.

3. Conduct Thorough Research (Due Diligence)

Before investing in any cryptocurrency, especially mid and small-caps, do your homework:

- Technology & Use Case: Does the project solve a real problem? Is its technology innovative and sustainable?

- Development Team & Community: Is the team reputable, experienced, and actively developing the project? Is there a strong, engaged community supporting it?

- Tokenomics: Understand the token’s supply (total, circulating), distribution, utility within the ecosystem, inflation rates, and any token burning mechanisms.

- Roadmap & Partnerships: Does the project have a clear roadmap for future development? Are there strategic partnerships that validate its potential?

- Market Capitalization & Competition: How does it compare to competitors in its sector?

- Regulatory Environment: Be aware of the legal status of the cryptocurrency in relevant jurisdictions. Regulatory changes can significantly impact prices.

4. Implement Smart Investment Strategies

- Dollar-Cost Averaging (DCA): Instead of investing a lump sum, invest a fixed amount regularly (e.g., weekly or monthly), regardless of the price. This mitigates the risk of buying at a market peak and averages out your purchase price over time. This is particularly effective in volatile markets.

- Risk Management with Stop-Loss Orders: For active trading, use stop-loss orders to automatically sell an asset if it drops to a predetermined price, limiting potential losses.

- Secure Storage: Do not leave all your assets on an exchange, especially for long-term holds.

- Cold Wallets (Hardware Wallets): Devices like Ledger or Trezor provide the highest security for long-term storage by keeping your private keys offline.

- Hot Wallets (Software Wallets): For smaller amounts and frequent trading, use reputable software wallets (e.g., Trust Wallet, MetaMask).

- Always enable two-factor authentication (2FA) on all exchange accounts and wallets.

5. Regular Portfolio Rebalancing

The crypto market is highly dynamic. Periodically review and rebalance your portfolio to maintain your desired asset allocation and risk exposure.

- Why Rebalance? Market fluctuations can cause certain assets to overperform or underperform, shifting your portfolio away from your target allocation. Rebalancing helps you lock in gains and reduce overexposure to any single asset.

- How to Rebalance:

- Set Intervals: Rebalance monthly, quarterly, or annually, depending on your preference and market volatility.

- Adjust Allocations: Sell portions of assets that have grown significantly (taking profits) and reallocate those funds to underperforming assets or to maintain your target percentages.

- Consider Thresholds: You might rebalance when an asset deviates by a certain percentage (e.g., 5% or 10%) from its target allocation.

6. Stay Informed and Educated

The crypto space evolves rapidly. Continuous learning is crucial:

- Follow Reputable News Sources: Stay updated on market trends, technological advancements, and regulatory changes.

- Understand Blockchain Fundamentals: Learn about the underlying technology of the projects you invest in.

- Be Wary of FOMO (Fear of Missing Out) and Hype: Do not make impulsive decisions based on social media trends or rumors. Stick to your research and investment strategy.

Conclusion

Building a balanced crypto portfolio in 2025 requires a strategic, disciplined, and informed approach. By defining your goals, diversifying wisely across different asset classes, conducting thorough research, employing smart investment strategies like DCA and risk management, and regularly rebalancing, you can position yourself for long-term success in this exciting yet volatile market. Remember, patience and a long-term perspective are key.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.