As 2025 draws to a close, the crypto market presents a fascinating paradox. It was a year where “crypto won” in terms of politics, regulation, and institutional adoption, yet prices for many assets—including Bitcoin—struggled to maintain their peaks.

For the “real investor,” 2025 was a filtering year: a period that separated speculative noise from fundamental utility, and short-term “moon-shot” chasers from those building long-term portfolios.

Crypto 2025 Recap: Why This Was a Filtering Year for Real Investors

1. The Price Paradox: $125k and the “Great Reset”

The year began with explosive momentum. Bitcoin shattered the six-figure ceiling early in the year, eventually peaking at an all-time high of approximately $126,000 in October. However, the fourth quarter brought a harsh reality check.

-

The Leverage Flush: In November 2025, the market experienced the “Great Leverage Reset.” Excessive risk-taking in derivatives led to a massive liquidation event, wiping out over $20 billion in positions and dragging BTC back to the $90,000 range.

-

The “Whale” Exit: As prices hit record highs, long-time holders (whales) seized the opportunity to cash out. This created a ceiling that even steady ETF inflows couldn’t immediately break.

-

The Takeaway: Real investors viewed this not as a “crash,” but as a necessary cleansing of the system. The exit of “weak hands” and over-leveraged traders created a healthier foundation for 2026.

2. Regulation: From “Wild West” to “Wall Street”

2025 was the year the “rules of the road” were finally written. This filtered out projects that couldn’t survive professional scrutiny.

-

The GENIUS Act: Passed in mid-2025, this landmark U.S. legislation provided the first federal framework for stablecoins. It gave traditional banks the “green light” to offer crypto custody and services.

-

SEC Leadership Shift: Under new leadership (Paul Atkins), the SEC moved from an “enforcement-first” approach to a “rules-first” regime. This shifted the focus toward actual investor harm rather than technical registration disputes.

-

ETF Expansion: The approval of Spot Solana and Spot XRP ETFs late in the year signaled that the “Big Three” era (BTC, ETH, and Stablecoins) was expanding to include a broader index of functional assets.

3. The Utility Shift: Stablecoins and Tokenization

While retail sentiment turned “extraordinarily negative” due to price volatility, institutional sentiment remained “unremittingly bullish.” The reason? Real-world utility.

| Trend | 2025 Impact | Why it Matters for Real Investors |

| Stablecoins | Market cap hit record $290B+ | They moved from “trading collateral” to a global settlement layer, settling more value than Visa in Q3. |

| RWAs | Tokenized Treasuries topped $8B | Real-world asset (RWA) tokenization moved from a “science project” to a core allocation for banks. |

| AI + Crypto | Autonomous smart contracts | Decentralized AI networks (like Fetch.ai) began optimizing on-chain execution, reducing human friction. |

4. Why 2025 Filtered the “Real” Investors

This year acted as a filter because it punished the speculative mindset while rewarding the structural mindset.

-

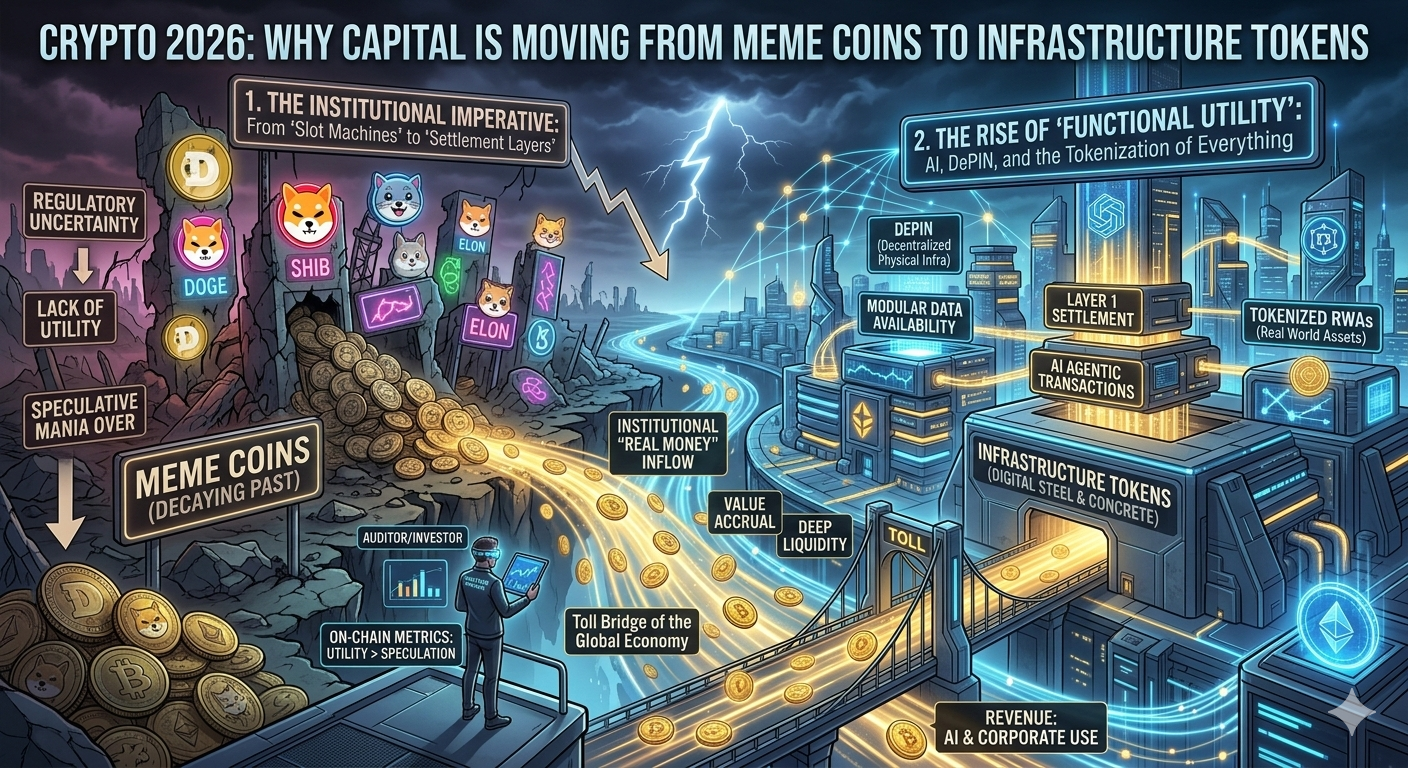

Fundamental Diligence over Hype: In 2025, “memecoin” cycles were shorter and more violent. Investors who moved toward “Investor Grade” tokens (those with real yield or utility) saw less volatility than those chasing viral trends.

-

Institutional Professionalism: With firms like Morgan Stanley and Merrill Lynch offering crypto ETFs to their clients, the market is no longer driven by Twitter (X) rumors, but by quarterly earnings, macro inflation data, and Federal Reserve policy.

-

The “Debasement Trade”: Real investors stayed the course because the macro thesis—hedging against high government debt and a declining dollar—became more relevant than ever, even if the price didn’t reflect it daily.

Summary of the 2025 Filter

| Speculator Experience | Real Investor Experience |

| Frustrated by $125k → $90k drop. | Relieved by the flush of toxic leverage. |

| Chasing the “next 100x” altcoin. | Increasing allocation to tokenized assets/ETFs. |

| Panicked by regulatory “rules.” | Bullish on the clarity and bank integration. |

Post-2025: The Rise of Quality and the Death of Noise

Building on the “filtering” effect of 2025, the market is entering 2026 with a fundamentally different DNA. If 2025 was the year of the “Great Reset,” 2026 is being hailed by analysts at firms like Grayscale and Coinbase as the “Dawn of the Institutional Era.” Here is a detailed breakdown of the structural shifts that are now defining the landscape for the “Real Investor.”

1. The End of the “Four-Year Cycle” Theory

For a decade, crypto was governed by the Bitcoin halving cycle—a predictable rhythm of boom and bust. In 2025, that rhythm broke.

-

The Paradigm Shift: Instead of a massive post-peak “crypto winter,” 2026 is projected to see sustained valuations driven by macro-economic necessity rather than retail hype.

-

The Catalyst: As global debt levels rise, institutional allocators are no longer treating BTC as a “tech trade” but as a scarce digital commodity—a hedge similar to gold.

-

Investor Insight: Real investors are moving away from timing the “top” and are instead focusing on permanent portfolio allocations (averaging 3–5% of AUM).

2. Tokenomics 2.0: The Rise of “Productive” Assets

The filter of 2025 decimated “ghost chains” and speculative tokens with no revenue. In their place, 2026 is seeing the rise of Cash-Flow Valuation models.

-

Fee-Sharing & Buybacks: Protocols are shifting away from “inflationary rewards” (printing more tokens) toward models that link token value to platform usage.

-

The “Fat App” Thesis: While 2021 was about the “Fat Protocol” (buying the L1 blockchain), 2026 is about the “Fat App.” Applications like decentralized perpetual exchanges and prediction markets are beginning to retain more value than the blockchains they sit on.

-

Enshrined Utility: Major Layer-1s (like Ethereum and Solana) are beginning to “enshrine” revenue-generating apps directly into their core code to return value to stakers.

3. The “Agentic” Economy (AI × Crypto)

The most significant technological bridge built in 2025 was between Artificial Intelligence and Blockchain.

-

AI Agents as Users: In 2026, many “users” on-chain are no longer humans, but autonomous AI agents. These agents require permissionless, 24/7 payment rails to buy data, compute power, and services.

-

Verifiable Content: With the explosion of AI-generated deepfakes, blockchain notarization has become the standard for “Proof of Personhood.”

-

DePIN Expansion: Decentralized Physical Infrastructure Networks (DePIN) for AI compute and energy storage are now attracting serious infrastructure capital, moving crypto from “software only” to “hardware-backed.”

4. Institutional Infrastructure: The $100B+ Club

The “filter” confirmed which assets Wall Street is willing to touch. By early 2026, the market structure has solidified around a few key pillars:

-

The ETF Powerhouse: Net inflows into Spot BTC and ETH ETFs are expected to exceed $50 billion in 2026.

-

Corporate Treasury Reform: New accounting rules (FASB) now allow companies to report crypto holdings at “fair market value.” This has removed the final barrier for Fortune 500 companies to hold BTC on their balance sheets without earnings volatility.

-

Stablecoin 2.0: With the U.S. GENIUS Act beginning implementation, stablecoins are moving from “trading chips” to “global settlement rails.” Major card networks (like Visa/Mastercard) are now processing a significant portion of cross-border settlements via regulated stablecoins.

Key Metrics for 2026

| Metric | 2025 Year-End (Est.) | 2026 Forecast |

| Bitcoin Price Target | ~$90,000 – $105,000 | $120,000 – $180,000 |

| Stablecoin Market Cap | ~$290 Billion | $500 Billion+ |

| DeFi TVL | ~$100 Billion | $200 Billion+ |

| Institutional Allocation | < 0.5% of AUM | 1% – 3% of AUM |

The “Real” Investor’s Checklist for 2026

Focus on “Yield-Bearing” Quality: Prioritize assets that generate real protocol revenue (e.g., LDO, AAVE, or Solana-based “Internet Capital” tokens).

Monitor the “Strategic Reserve”: Watch for government-level moves (sovereign wealth funds or national reserves) as the ultimate validation of the “Digital Gold” thesis.

Avoid “Meme Fatigue”: While memecoins will always exist, the 2025 filter proved they are high-risk distractions from the structural growth of the digital economy.

Conclusion

In summary, 2025 will be remembered not as the end of crypto, but as the end of its “adolescence.” It was the year the market stopped asking for permission to exist and started answering for its performance.

The Verdict: A Structural Victory

While speculators may look at the year-end volatility with frustration, the “real investor” sees a landscape that has been professionally sanitized. The $1.2 trillion “flush” in late 2025 didn’t break the system—it proved the system could handle a massive deleveraging without a centralized bailout.

Final Takeaways for the Path Ahead:

-

The Death of the “Cycle”: The rigid four-year halving cycle has been replaced by a more nuanced “Institutional S-Curve.” Price action is now driven by global liquidity, corporate balance sheets, and ETF mandates rather than just retail FOMO.

-

From Narrative to Numbers: The time for “investing in stories” is over. Whether it is a Layer-2’s transaction revenue or an AI protocol’s compute demand, 2026 will demand verifiable unit economics.

-

Institutional Plumbing: With the GENIUS Act and FASB accounting rules now in place, the bridge to traditional finance is no longer a rickety rope bridge; it is a multi-lane highway.

Looking Forward to 2026

As we cross into the new year, the “filter” has left behind a leaner, more resilient market. The next phase isn’t about if crypto will be integrated into the world’s financial core, but how fast that integration will scale. For those who survived the 2025 reset, the reward is a front-row seat to the most significant financial infrastructure upgrade in a generation.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.