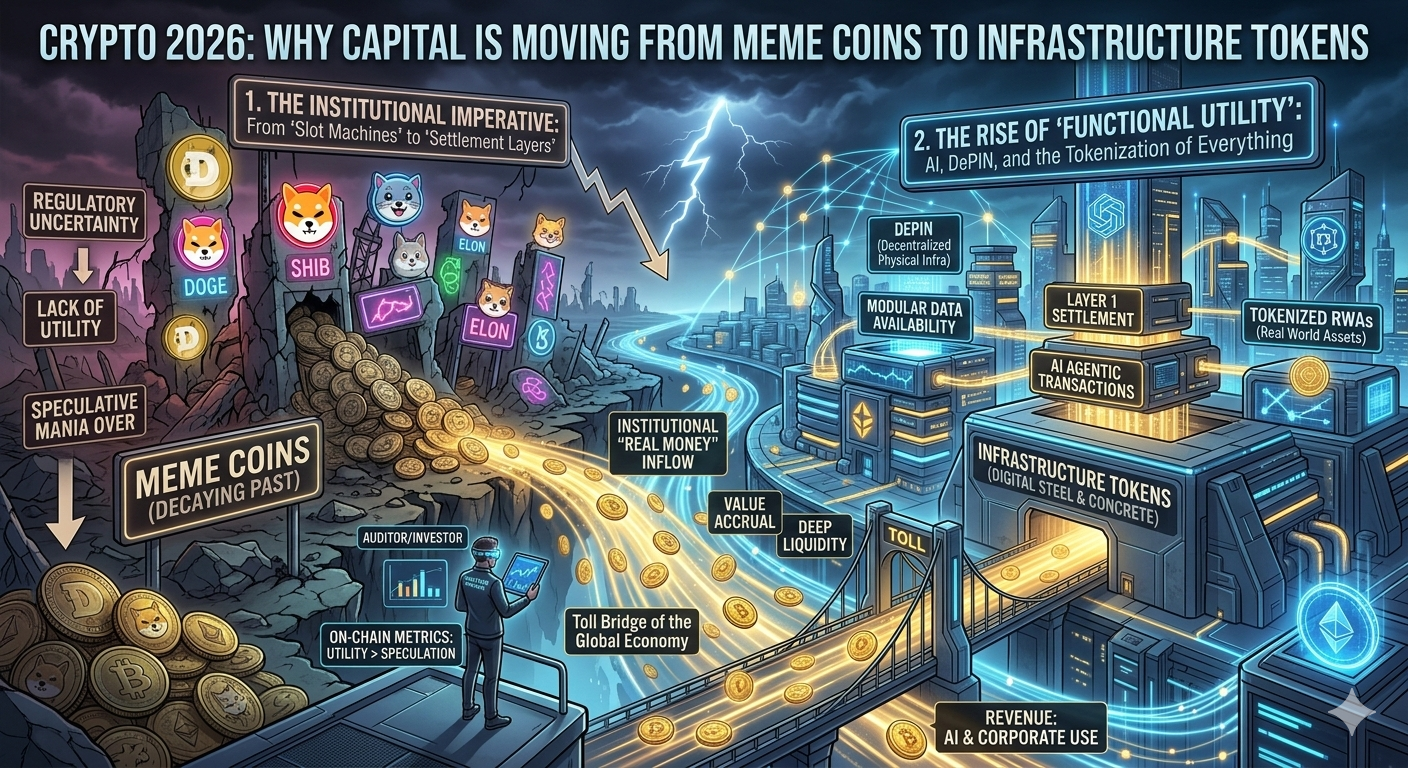

In 2026, the era of “amateur” crypto investing is coming to a close. The market has shifted from a speculative “wild west” into a sophisticated asset class defined by institutional capital, real-world utility, and the end of the traditional four-year cycle.

Building a “smarter” portfolio today requires moving beyond simply picking coins; it demands a strategic allocation across emerging sectors like Real World Assets (RWA), AI-integrated blockchains, and institutional-grade infrastructure. Here is a comprehensive guide to constructing a resilient, high-growth crypto portfolio for 2026.

Building a Smarter Crypto Portfolio for 2026

1. The Core: “Digital Gold” and the “Global Computer”

A smart portfolio begins with stability. In 2026, Bitcoin (BTC) and Ethereum (ETH) are no longer just experiments—they are the bedrock of digital finance.

-

Bitcoin (40-50%): With the proliferation of spot ETFs and its adoption as a corporate treasury reserve (led by giants like MicroStrategy), Bitcoin’s role is purely as a store of value. It provides the “low-beta” stability your portfolio needs during market turbulence.

-

Ethereum (20-25%): Ethereum remains the indispensable “Global Computer.” Even with the rise of competitors, the majority of institutional tokenization—like BlackRock’s BUIDL fund—happens on Ethereum or its Layer-2 extensions. Holding ETH is a bet on the underlying plumbing of the new financial system.

2. The Infrastructure Layer: Scalability and Oracles

For the “on-chain” economy to function, it needs speed and data. This sector captures the growth of decentralized applications (dApps) and institutional integration.

High-Performance Layer-1s

While Ethereum is the leader, high-speed alternatives are capturing massive retail and enterprise volume.

-

Solana (SOL): Known for its high throughput, Solana has become the home for consumer-facing apps and “DePIN” (Decentralized Physical Infrastructure Networks).

-

Monad (MON): A rising star in 2026, Monad offers EVM-compatibility with parallel execution, aiming to merge Ethereum’s ecosystem with Solana’s speed.

The Oracle Backbone

-

Chainlink (LINK): As real-world assets (RWAs) like real estate and T-bills move on-chain, they require reliable price feeds. Chainlink’s CCIP (Cross-Chain Interoperability Protocol) has become the industry standard for connecting traditional banks to public blockchains.

3. Emerging Narrative: Real World Assets (RWA)

2026 is widely considered the “Year of RWA.” Tokenization is no longer a buzzword; it is a trillion-dollar shift in how value is moved. Smart investors should allocate 10-15% to this sector.

| Asset Type | Key Projects to Watch | Why it Matters |

| Private Credit/Debt | Ondo, Centrifuge | Brings high-yield US Treasuries and corporate debt to anyone with a wallet. |

| Real Estate | Propy, RealT | Allows fractional ownership of property, providing rental income on-chain. |

| Commodities | Paxos (Gold) | Tokenized gold provides a hedge against fiat debasement without physical storage issues. |

4. The AI and DePIN Convergence

The intersection of Artificial Intelligence and Crypto is the fastest-growing niche in 2026. This isn’t just about “AI coins,” but about using blockchain to solve AI’s biggest problems: compute power and data ownership.

-

Decentralized Compute (DePIN): Projects like Render (RNDR) and Akash allow users to rent out GPU power for AI training.

-

AI Agents: Keep an eye on Fetch.ai (FET/ASI) and NEAR Protocol. These platforms enable autonomous agents to perform financial transactions, such as automatically rebalancing your portfolio or hunting for the best DeFi yields without human intervention.

5. Risk Management for the “New Paradigm”

The “four-year cycle” (where crypto crashed every four years) is fading as institutional inflows provide a “floor” to the market. However, volatility remains.

The 1% Rule: Never risk more than 1% of your total portfolio value on a single high-risk “moonshot” or meme coin.

Yield-Bearing Stablecoins: In 2026, smart investors don’t just hold USDC or USDT. They hold yield-bearing versions (like JupUSD or USDi) that earn interest from tokenized T-bills while remaining liquid.

Strategic Allocation Model (Balanced/Aggressive)

-

40% Bitcoin: Core safety.

-

20% Ethereum: Smart contract exposure.

-

15% High-Performance L1s: (Solana, Monad, Sui).

-

10% RWA & Oracles: (Ondo, Chainlink).

-

10% AI & DePIN: (Render, NEAR, Bittensor).

-

5% Moonshots: Early-stage gaming or niche DeFi protocols.

6. Closing Thoughts

Building a smarter portfolio in 2026 requires a “barbell” strategy: heavy weight in the established “blue chips” (BTC/ETH) to capture institutional growth, balanced by a calculated stake in the technological frontier (AI/RWA).

The goal is no longer to “get lucky” on a single token, but to own a piece of the infrastructure that is replacing traditional finance.

The Shift from Speculation to Systemic Management: On-Chain Sophistication

In the previous cycles, “managing” a portfolio meant checking price apps and hoping for a pump. In 2026, a “smarter” portfolio is defined by how it generates internal velocity—meaning your assets should be working for you even when the market is sideways.

The Rise of “LSTfi” (Liquid Staking Finance)

By 2026, simply holding ETH or SOL in a cold wallet is considered an opportunity cost. Smart investors utilize Liquid Staking Tokens (LSTs). When you stake your assets to secure the network, you receive a representative token (like stETH or jitoSOL).

-

Capital Efficiency: You earn the base staking rewards (usually 3-5%) while using that same “receipt” token as collateral in DeFi to mint stablecoins or provide liquidity.

-

Risk Layering: A smarter portfolio uses a “layered” approach where the bottom layer is the yield-bearing asset, and the top layer is the strategic deployment of that yield.

Automation and the “Intent-Centric” Era

One of the biggest hurdles in crypto has always been complexity. In 2026, we have moved toward Intent-Centric Protocols.

-

What it is: Instead of manually bridging assets from Ethereum to an L2 or swapping on a DEX, you state your “intent” (e.g., “I want to earn 8% yield on my USDC with the lowest risk”).

-

The Benefit: AI-driven “solvers” find the most efficient path across the entire multi-chain landscape to execute your request. This reduces “slippage” and gas fees, which historically ate away at retail investor profits.

Regulatory Compliance as a Feature, Not a Bug

In 2026, the divide between “Clean Crypto” and “Dark Crypto” is clear.

-

Institutional Pools: Many DeFi protocols now offer “permissioned” pools that require a basic KYC (Know Your Customer) credential held in your wallet (as a non-transferable NFT).

-

The Alpha: Smarter portfolios allocate a portion to these permissioned pools. Why? Because that is where the “big money” from pension funds and banks sits. These pools often have lower volatility and more sustainable yields because they aren’t filled with mercenary retail capital looking to “dump” at the first sign of a price drop.

The “Anti-Fragile” Exit Strategy

Finally, a smart portfolio in 2026 incorporates Dynamic Rebalancing.

-

The Volatility Harvest: Instead of selling your entire position during a bull run, smart investors use automated “Limit Orders” or “DCA-out” (Dollar Cost Averaging out) strategies.

-

Stablecoin Diversification: Not all stables are equal. A smart portfolio diversifies its “exit” cash into a mix of centralized stables (USDC), decentralized over-collateralized stables (crvUSD), and yield-bearing T-bill tokens. This ensures that even if one issuer faces regulatory pressure, your “dry powder” remains safe.

Conclusion: From “Moonshots” to Meaningful Allocation

As we navigate 2026, the primary takeaway for any serious investor is that the “Wild West” era of cryptocurrency has matured into a sophisticated financial frontier. The strategies that worked in 2020 or 2021—chasing hype on social media and hoping for a 100x return—are increasingly replaced by institutional frameworks, real-world utility, and systemic yield generation.

The New Standard of Success

Success in this cycle is no longer defined by “timing the top,” but by architecting a resilient ecosystem. A smarter portfolio in 2026 is one that:

-

Embraces Stability: Uses Bitcoin and Ethereum as the “ballast” to weather market swings.

-

Captures Utility: Allocates to sectors like RWA and DePIN that solve actual physical and digital problems.

-

Prioritizes Velocity: Ensures that assets are never “idle” but are instead earning through liquid staking or automated DeFi vaults.

Final Thoughts

The convergence of AI, institutional capital, and blockchain infrastructure is creating a “supercycle” of production. While volatility will never truly disappear from the crypto markets, the “floor” has fundamentally shifted higher. We are no longer betting on whether these technologies will survive; we are now calculating how they will scale.

As you build your portfolio for the remainder of 2026 and look toward 2030, remember that the most valuable asset you possess isn’t just your capital—it is your patience and your process. By moving away from a speculative mindset and toward an “owner-operator” mentality, you position yourself not just to survive the next market shift, but to thrive within the new digital economy.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.