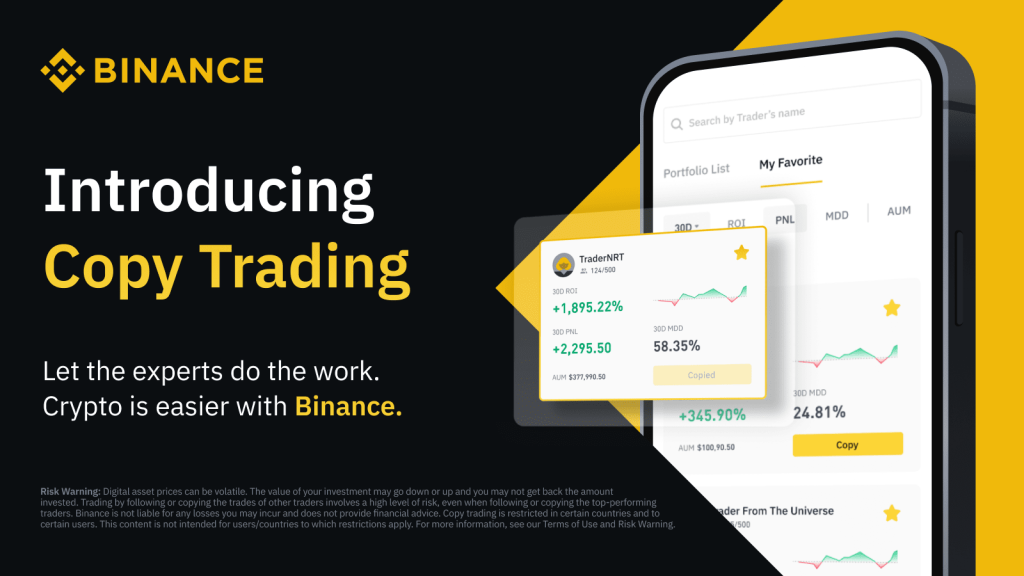

This blog will show everything you need to know about Binance Copy Trading, including how to copy trade on Binance Futures, the pros and cons of using a Binance Copy Trading bot, and tips for choosing the best Binance copy trader.

Introduction to Binance Copy Trading

In the world of cryptocurrency trading, one of the biggest challenges for beginners is making profitable trades. With the volatile nature of the market and the constant influx of new information, it can be overwhelming for new traders to keep up and make sound investment decisions.

This is where Binance Copy Trading comes in. Binance Copy Trading is a relatively new concept that allows beginner traders to automatically copy the trades of experienced and successful traders. One platform that offers this service is Binance, one of the largest and most popular cryptocurrency exchanges in the world.

In this blog post, we will explore the concept of Binance copy trading, its benefits, how to get started, top traders to follow, risk management strategies, and tips for maximizing profits. We will also discuss common mistakes to avoid and future trends in Binance copy trading. So let’s dive in!

Benefits of Binance Copy Trading

Binance Copy Trading offers numerous benefits for both beginner and experienced traders. Here are some of the key advantages of using this feature on the Binance platform:

- Access to Experienced Traders’ Strategies – As a beginner trader, it can be challenging to develop a profitable trading strategy. With Binance Copy Trading, you have access to a pool of experienced traders who have a proven track record of success. This allows you to learn from their strategies and potentially replicate their success.

- Saves Time and Effort – Binance Copy Trading eliminates the need for extensive research and analysis, which can be time-consuming and exhausting. By following successful traders, you can sit back and relax while their trades are automatically copied into your account.

- Diversification – Binance Copy Trading allows you to diversify your portfolio by copying trades from multiple successful traders. This reduces the risk of relying on a single trader’s performance and can potentially lead to more consistent profits.

- Suitable for Beginners – Binance Copy Trading is an excellent option for beginners who may not have the knowledge or experience to make profitable trades. By following successful traders, they can learn from their strategies and gradually gain confidence and knowledge in the market.

- Low Minimum Investment – Binance Copy Trading allows you to start with a small investment, as low as $10. This makes it accessible for traders with limited funds and reduces the barrier to entry for beginners.

How to Get Started with Binance Copy Trading

Now that you understand the benefits of Binance Copy Trading, let’s explore how you can get started on the platform. Here are the steps to follow:

- Create a Binance Account – The first step is to create an account on the Binance platform if you don’t already have one. It’s a straightforward process that requires basic personal information and email verification.

- Complete KYC Verification – To access the Binance Copy Trading feature, you will need to complete the Know Your Customer (KYC) verification process. This involves providing identification documents such as a passport or driver’s license and a photo of yourself holding the document.

- Choose the Copy Trading Tab – Once your account is verified, click on the “Copy Trading” tab on the Binance homepage. This will open the copy trading section where you can browse through the available traders to follow.

- Choose Traders to Follow – Binance provides an extensive list of traders to choose from, including their performance statistics and risk levels. You can select multiple traders to follow, depending on your preferences and risk appetite.

- Set Up Your Copy Trading Portfolio – After selecting your preferred traders, you can choose the amount you want to allocate to each trader. You can also set stop-loss and take-profit parameters for each trade to manage your risk.

- Monitor Your Portfolio – Once your portfolio is set up, you can monitor the trades and performance of your chosen traders. You can also make changes to your portfolio at any time, such as adding or removing traders.

Top Traders to Follow on Binance Copy Trading

Choosing the right traders to follow is crucial for success in copy trading. Here are some of the top traders on Binance Copy Trading based on their past performance:

- Sergey K – With a total profit of over 1900% and average monthly returns of 30%, Sergey K is one of the most successful traders on Binance Copy Trading. His trading strategy focuses on long-term investments with a mix of high-risk and low-risk assets.

- Chris S. – Chris S. has an impressive average monthly return of 45% and a total profit of over 1200%. His trading strategy involves a mix of short-term and long-term trades with a focus on high-volume, low-risk assets.

- Akin F. – Akin F. has a total profit of over 1000% and an average monthly return of 17%. His trading style is relatively conservative, focusing on low-risk, high-potential trades. He also provides regular updates and insights on his trading decisions to help his followers understand his strategies better.

- Marko M. – Marko M. has a total profit of over 1500% and an average monthly return of 25%. His approach involves taking advantage of market volatility and making quick trades to capitalize on short-term opportunities.

Risk Management in Binance Copy Trading

Risk management is a crucial aspect of any trading strategy, including copy trading. While following successful traders can increase your chances of making profitable trades, there is always a risk involved in the market. Here are some risk management techniques you can implement in your Binance Copy Trading portfolio:

- Diversify Your Portfolio – As mentioned earlier, diversifying your portfolio by following multiple traders can reduce the risk of relying on a single trader’s performance. It is essential to have a mix of high-risk and low-risk traders in your portfolio.

- Choose Traders with a Proven Track Record – Before selecting a trader to follow, make sure to research their past performance and success rate. Look for traders with a consistent track record of profits to increase your chances of making profitable trades.

- Set Risk Parameters – Binance copy trading allows you to set stop-loss and take-profit parameters for each trade. This means that if a trade reaches a certain profit or loss level, it will automatically close to manage your risk.

- Regularly Monitor Your Portfolio – It is crucial to regularly monitor your portfolio and make changes if necessary. If a trader’s performance starts to decline, it may be wise to remove them from your portfolio to minimize potential losses.

Monitoring Your Binance Copy Trading Portfolio

Binance provides several tools and features to help you monitor and manage your copy trading portfolio. Here are some of them:

- Portfolio Dashboard – The portfolio dashboard displays all the traders you are currently following, their performance statistics, and the amount allocated to each. It also shows your total profit and loss, allowing you to track your overall performance.

- Performance Charts – Binance provides performance charts for each trader, showing their daily, weekly, and monthly returns. You can use these charts to analyze the success rate of each trader and make decisions about who to follow or remove from your portfolio.

- Notifications – Binance sends regular notifications to keep you updated on the performance of your chosen traders. You can also set up custom alerts for specific traders or when a trade reaches a particular profit or loss level.

Choosing the Right Trading Strategy on Binance Copy Trading

There are several trading strategies you can follow on Binance Copy Trading, depending on your risk appetite and goals. Here are some of the common strategies used by successful traders:

- Short-Term Trading – This strategy involves making quick trades to take advantage of short-term price fluctuations in the market. Traders using this strategy typically focus on high-volume, low-risk assets and aim for smaller but more frequent profits.

- Long-Term Trading – Long-term trading involves holding onto assets for an extended period, usually months or even years. This strategy is less volatile than short-term trading and is suited for those looking for more stable long-term gains.

- Scalping – Scalping is a short-term trading strategy that involves making multiple trades throughout the day and aiming for small profits from each trade. It requires close monitoring of the market and quick decision-making to capitalize on small price movements.

- Swing Trading – Swing trading involves holding onto assets for a few days or weeks, taking advantage of medium-term price fluctuations. Traders using this strategy typically analyze market trends and make trades based on technical analysis.

Maximizing Profits through Binance Copy Trading

While Binance Copy Trading can be a profitable venture, it’s not a guarantee for success. Here are some tips to help you maximize your profits:

- Research and Analyze – While you may be following successful traders, it is essential to do your own research and analysis to understand their strategies better. This will allow you to make informed decisions and potentially identify new traders to follow.

- Start with a Small Investment – As a beginner, it’s best to start with a small investment and gradually increase it as you gain more experience and confidence in the market. This also reduces the risk of significant losses if a trader’s performance declines.

- Stay Informed – Keep yourself updated on the latest news and developments in the cryptocurrency market. This will help you make more informed decisions about which traders to follow and when to make changes to your portfolio.

- Diversify Your Portfolio – As mentioned earlier, diversifying your portfolio is crucial for minimizing risk and maximizing profits. Follow a mix of high-risk and low-risk traders with different trading strategies to spread out your investments.

- Regularly Monitor and Adjust Your Portfolio – It’s essential to regularly monitor your portfolio and make changes if necessary. If a trader’s performance starts to decline, it may be wise to remove them from your portfolio and replace them with a new one.

Common Mistakes to Avoid in Binance Copy Trading

As with any trading venture, there are some common mistakes that beginners tend to make in Binance Copy Trading. Here are some of them and how to avoid them:

- Not Doing Your Own Research – While following successful traders can be beneficial, it’s vital to do your own research and analysis to understand their strategies better.

- Copying Trades without Understanding – It’s essential to understand why a trader is making a particular trade and how it fits into their overall strategy. Blindly copying trades without understanding can lead to losses.

- Not Diversifying Your Portfolio – It’s crucial to have a diverse portfolio with a mix of traders and strategies to minimize risk. Relying on a single trader or strategy can result in significant losses if they perform poorly.

- Starting with a Large Investment – As a beginner, it’s best to start with a small investment and gradually increase it as you gain more experience and confidence in the market. Starting with a large amount can result in significant losses if a trader’s performance declines.

- Ignoring Risk Management Strategies – Risk management is crucial in Binance copy trading, and ignoring it can result in significant losses. It’s essential to set stop-loss and take-profit parameters for each trade and regularly monitor your portfolio.

Future Trends in Binance Copy Trading

As cryptocurrency trading continues to gain popularity, we can expect to see some exciting developments in Binance Copy Trading in the future. Some of these trends may include:

- Integration with Social Trading Platforms – Social trading platforms allow traders to interact and share information, strategies, and insights. Integrating Binance copy trading with social trading platforms can provide valuable information for traders to make better decisions.

- Artificial Intelligence (AI) – With the advancements in AI technology, we may see the incorporation of AI algorithms in copy trading platforms. This can help traders identify patterns and make more informed investment decisions.

- More Diverse Range of Traders – As Binance Copy Trading gains popularity, we can expect to see a more diverse range of traders on the platform. This means that traders with varying levels of experience and success rates will be available to follow.

- Increased Focus on Risk Management – As the market becomes more volatile, risk management will become even more crucial in copy trading. We can expect to see more tools and features focused on managing risk and reducing potential losses.

Conclusion

Binance Copy Trading is an excellent option for both beginner and experienced traders looking to make profitable trades in the volatile cryptocurrency market. By following successful traders and implementing risk management strategies, you can potentially increase your chances of making consistent profits.

However, it’s essential to do your own research and carefully select traders to follow, diversify your portfolio, and regularly monitor and adjust your investments. By avoiding common mistakes and staying informed about the latest trends, you can stay ahead of the game and maximize your profits in Binance copy trading.