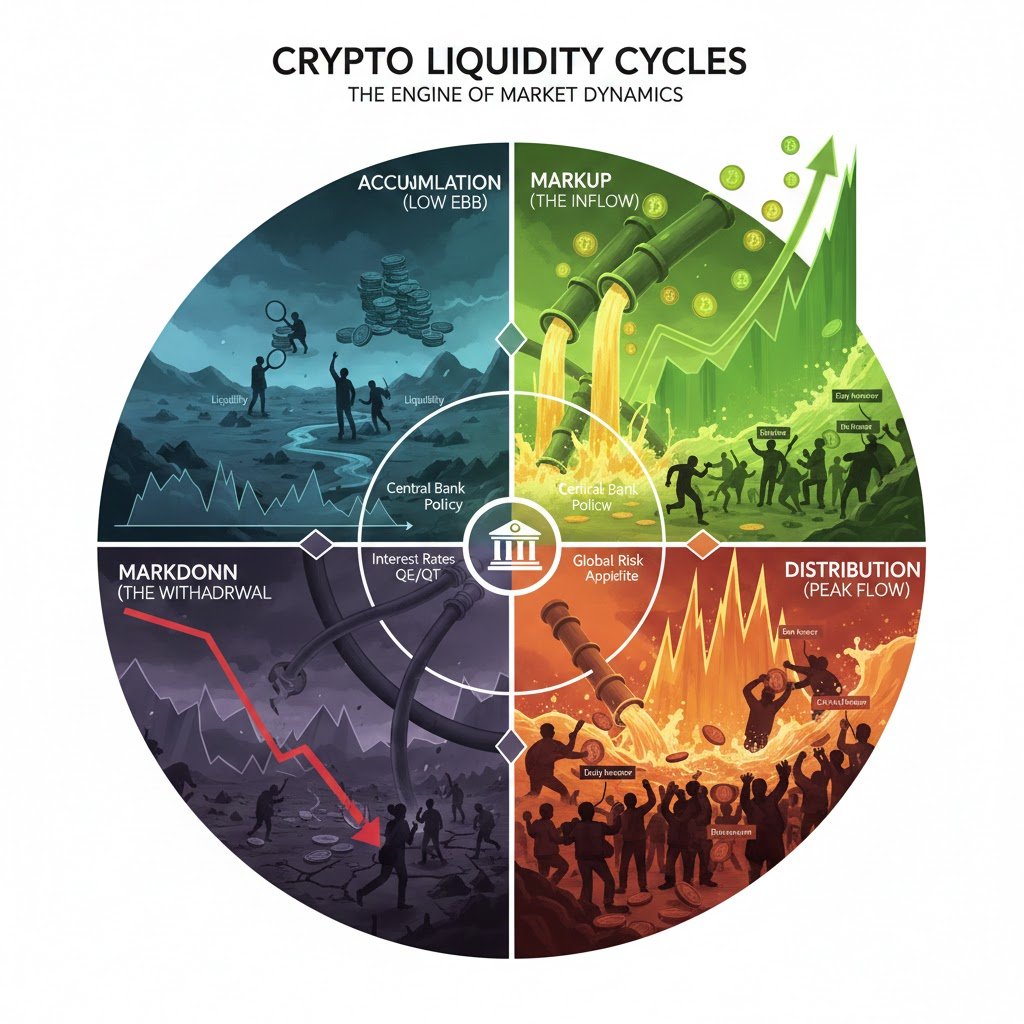

The Crypto Liquidity Cycle is the fundamental, macro-driven force that dictates the flow of capital (liquidity) into and out of the volatile digital asset market. Understanding this cycle is more crucial than relying on technical analysis or price predictions alone, as liquidity is the fuel for every major price move.

The cycle is typically divided into four phases—Accumulation, Markup, Distribution, and Markdown—which are driven by changes in global risk appetite, primarily influenced by central bank monetary policy (interest rates, quantitative easing/tightening).

4-Step Strategy Guide: Trading the Crypto Liquidity Cycles

This four-step strategy is built around identifying the distinct characteristics of each phase of the market cycle to manage risk and maximize potential returns.

Step 1: Identify the Current Cycle Phase (The Structural View)

The first step is to discard short-term noise and determine which of the four major phases the market is currently in. You look for structural evidence based on price action, volume, and dominant sentiment.

| Phase | Price Action | Volume & Liquidity | Dominant Sentiment | Strategic Goal |

| 1. Accumulation | Prices flatline or move sideways in a tight range, often after a sharp, multi-month drop. | Low, often decreasing; liquidity is scarce. | Disbelief/Despair. Media is quiet or negative. | Strategic Buying. |

| 2. Markup (Bull Run) | Prices break out and establish a sustained, consistent uptrend with higher lows and higher highs. | Increasing steadily as new retail and institutional capital flows in. | Optimism/Belief. Initial mainstream media attention returns. | Holding/Adding to Positions. |

| 3. Distribution | Prices peak and become volatile, often experiencing sharp, mixed movements without making substantial new highs. | High, but selling volume often spikes sharply on dips. Liquidity is at its peak. | Euphoria/Greed/FOMO. Everyone is talking about crypto. | Strategic Selling/Taking Profit. |

| 4. Markdown (Bear Market) | Prices experience a sharp, significant, and persistent downtrend; lower highs and lower lows. | Volume can spike during panic sell-offs, but overall interest/volume declines. | Fear/Panic/Capitulation. Focus on losses and market failures. | Patience/Risk Management. |

Step 2: Use Indicators to Confirm Phase Transition (The Tactical View)

While the structural view gives you the where in the cycle, technical and on-chain indicators help confirm a transition from one phase to the next.

-

For Accumulation Confirmation: Look for the Relative Strength Index (RSI) to trend in the oversold territory (below 30) for an extended period, suggesting selling pressure is exhausted.

-

For Markup Confirmation: Look for a breakout on high volume. The Moving Average Convergence Divergence (MACD) crossing above its signal line from a deeply negative position is a classic signal of rising momentum.

-

For Distribution Confirmation: Look for Negative Divergence—where the price makes a new high, but momentum indicators like RSI or MACD fail to make a corresponding new high. This signals that buying power is weakening even as prices are pushed up by final retail FOMO.

-

For Markdown Confirmation: The 50-day Moving Average (MA) crosses below the 200-day MA (a “Death Cross”), confirming a long-term downtrend.

Step 3: Align Trading Strategy with Phase Risk Profile (The Action Plan)

Each phase dictates a different risk profile and requires a distinct trading approach.

-

Phase 1: Accumulation Strategy: This is the best time for Dollar-Cost Averaging (DCA). Risk is highest in terms of time (the phase can last for months or years), but lowest in terms of price. The goal is patient, quiet accumulation of high-conviction assets.

-

Phase 2: Markup Strategy: Shift from DCA to Momentum Trading/Swing Trading. Buy dips with a clear bullish structure and hold core positions. Use stop-losses to protect against unexpected, sharp pullbacks (which are common in bull markets).

-

Phase 3: Distribution Strategy: Shift from buying to Selling and Profit Taking. Instead of trying to pick the absolute top, execute a structured Stair-Step Selling Strategy (e.g., sell 10% of your holdings every time the price hits a new psychological milestone or exhibits negative divergence). Your primary goal is capital preservation.

-

Phase 4: Markdown Strategy: Focus entirely on Risk Management. Avoid trying to “catch the falling knife.” If you are not shorting, this is the time for patience, moving capital to stablecoins, or setting deep limit buy orders for the next Accumulation phase.

Step 4: Monitor Global Liquidity Metrics (The Macro Confirmation)

For the most sophisticated traders, the key signal for the entire cycle is the flow of Global Liquidity. Crypto is a risk asset highly correlated with the availability of cheap, easy money.

-

Key Macro Indicators to Watch:

-

Federal Reserve (Fed) Interest Rates: Rising rates reduce the money supply available for risky assets like crypto. Falling rates or “money printing” increase liquidity.

-

Fed Balance Sheet (Quantitative Easing/Tightening): An expanding balance sheet (QE) injects liquidity; a shrinking one (QT) removes it and is a major headwind for crypto.

-

Global Money Supply (M2): Tracking global M2 growth gives a sense of the overall amount of cash available to flow into markets.

-

Changes in these macro drivers typically precede the price action in the crypto cycle, acting as a crucial long-term warning or confirmation signal. For instance, the transition from a Markup phase to Distribution is often triggered by a central bank shifting from an accommodative (easy money) to a tightening (dear money) policy stance.

Why Liquidity Cycles Matter More Than Price Predictions

Focusing on the liquidity cycle provides a superior framework for long-term investment strategy and risk management compared to relying on singular, often sensationalized, price predictions. While a price prediction might tell you where a coin might go, the liquidity cycle tells you why it is capable of going there, when the environment is ripe for that move, and how likely the move is to reverse.

Here are the critical reasons why liquidity cycles supersede simple price forecasts:

1. Liquidity is the Fundamental Engine of Price

In the crypto market, especially for non-yielding assets like Bitcoin (BTC) and Ethereum (ETH), price is primarily a function of supply and demand for risk capital, not traditional cash flow analysis.

-

The Global Macro Link: Crypto is increasingly behaving like a “high-beta gauge of global liquidity”—a fast-moving canary in the coal mine for risk assets worldwide. When central banks engage in quantitative easing (QE) and keep interest rates low (accommodative policy), there is an abundance of cheap money (liquidity) seeking high returns. This capital floods into high-risk assets like crypto, causing prices to soar during the Markup phase.

-

The Headwind Effect: Conversely, when central banks enact Quantitative Tightening (QT) or raise interest rates (tightening policy), the cost of capital rises, and global liquidity is withdrawn. Crypto, sitting at the high-risk end of the spectrum, is often the first and most violently affected market, leading to the Markdown phase.

-

The Inelastic Supply: For assets like Bitcoin, the supply schedule is fixed and inelastic (cannot easily be changed). When demand, fueled by abundant global liquidity, surges against this fixed supply, the resulting price appreciation is often explosive, far outpacing what any single price prediction might capture.

2. Predictions are Noise; Cycles are Structure

Price predictions often rely on technical analysis of the past, emotional sentiment, or isolated news events. Liquidity cycles, however, rely on deep, fundamental economic drivers.

-

Structure vs. Noise: Liquidity cycles provide a structural framework that dictates the entire environment. A prediction might call for BTC to reach $100,000, but if the global liquidity cycle is deep in the Distribution phase (tightening macro conditions), that prediction is fundamentally disconnected from reality. The cycle lets you see the forest, not just the trees.

-

Risk Management Framework: When you know the market is in a Distribution phase due to tightening liquidity, your strategy shifts from seeking profits to capital preservation, regardless of how many analysts are predicting higher prices. Understanding the phase allows you to scale out of positions safely.

-

Identifying Opportunities: The Accumulation phase—when prices are low, and liquidity is scarce but stabilizing—presents the lowest risk entry points for long-term holders. This is the time to ignore the prevailing bearish price predictions and strategically accumulate for the next cycle’s markup.

3. Stability and On-Chain Liquidity Metrics

Focusing on liquidity offers more robust, real-time indicators that are native to the crypto ecosystem itself.

-

Stablecoin Supply: A highly effective, crypto-native liquidity metric is the total supply and flow of major stablecoins (USDT, USDC, etc.). Stablecoins represent fiat currency that has been converted into the crypto ecosystem, ready to be deployed into risk assets.

-

Rising Stablecoin Supply (or increased rate of change) means fresh capital is waiting on the sidelines, often preceding the start of a rally.

-

Decreasing Stablecoin Supply can signal that capital is being withdrawn (redeemed back to fiat) or that the market is in a risk-off mode, confirming distribution/markdown.

-

-

Exchange Order Books: Monitoring the depth of the order books (buy and sell walls) provides a direct, on-chain measure of market depth and volatility. Thin liquidity (shallow order books) means a relatively small amount of capital can cause a massive price swing, amplifying the cycle’s moves.

In summary, price predictions are often speculative targets, whereas liquidity cycles are the observable, repeatable economic law governing the crypto market. By aligning your strategy with the flow of global and crypto-native capital, you move beyond mere speculation and adopt a data-driven, macroeconomic investment approach.

Conclusion: The Supremacy of the Liquidity Cycle

The Crypto Liquidity Cycle is not just another analytical tool; it is the fundamental law governing the booms and busts of the digital asset market. It reveals that the volatility and major trend changes in crypto are not random, but are intrinsically linked to the global availability and flow of cheap risk capital.

Summary of Core Takeaways:

-

Liquidity is the Fuel: The cycle is ultimately driven by the monetary policies of central banks (interest rates and balance sheet management). When liquidity is abundant, capital flows to high-risk assets, fueling the Markup phase. When liquidity tightens, capital is withdrawn, triggering the Markdown phase.

-

The 4-Step Strategy is Structural: By identifying the four distinct phases—Accumulation, Markup, Distribution, and Markdown—investors gain a robust framework to align their strategy (Buying, Holding, Selling, or Waiting) with the prevailing risk environment.

-

Cycles > Predictions: While price predictions offer short-term targets, the liquidity cycle provides the context, risk profile, and directional probability for the entire market. Ignoring the cycle is trading against the macroeconomic tide.

-

Crypto is a Macro Asset: Bitcoin and the wider crypto market are increasingly behaving as a highly sensitive gauge of global risk appetite. Monitoring on-chain liquidity metrics, like stablecoin flows, offers real-time confirmation of which phase the cycle is entering.

In essence, successful navigation of the volatile crypto market demands a shift in focus from the excitement of what price might be to the critical understanding of why the market is capable of that price action. Mastering the liquidity cycle is the difference between speculating and strategically investing.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

🔹 Binance – A global leader in cryptocurrency trading.

🔹 Bybit – A user-friendly platform for both beginners and advanced traders.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

🚀 Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: OCBCryptoHub on Telegram.

📩 For collaborations and inquiries: datnk710@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.